Phemex vs MEXC: Comparison at a Glance

When comparing Phemex and MEXC, you’ll want to consider their histories, features, and services in the dynamic crypto exchange marketplace.

MEXC, established in 2018 and headquartered in Singapore, offers a variety of trading options. These include spot, margin, and futures.

Phemex is renowned for its claim as the fastest cryptocurrency exchange, providing enticing features such as a welcome bonus and zero-fee trading for premium members.

Below is a table that encapsulates the primary characteristics of these two platforms:

| Feature | Phemex | MEXC |

|---|---|---|

| Founded | 2019 | 2018 |

| Trading Options | Spot, Contract, Futures | Spot, Margin, Futures |

| Trading Fees | Low; Zero for Premium | Competitive |

| Supported Cryptos | Numerous, including major | Numerous, including major |

| Leverage | Up to 100x | Up to 100x |

| Deposit Methods | Crypto, Bank Transfer | Crypto, Bank Card |

| User Interface | Intuitive | User-friendly |

| Volume (30 days) | High volume | High volume |

| NFT Marketplace | Not directly supported | Various markets listed |

As you evaluate the quality of each exchange, note that user scores often reflect the experience with the interface, support, and reliability of the platform.

Your selection between Phemex and MEXC may depend on your preference for certain exchange comparison features, such as zero-fee trading with Phemex or the vast NFT marketplace availability on MEXC.

Phemex vs MEXC: Products and Services

When you assess Phemex and MEXC’s offerings, you’ll find that both platforms offer a broad range of products and services catering to crypto traders and investors.

Spot Trading

Both exchanges provide you with spot trading capabilities.

Phemex is known for its user-friendly platform, which helps you navigate and trade various cryptocurrencies efficiently.

MEXC, on the other hand, boasts a vast selection of over 1,600 cryptocurrencies, making it a robust platform for exploring new tokens and established coins.

Futures & Derivatives Trading

Phemex offers you various trading pairs for futures and derivatives trading with competitive fees. You benefit from a maker fee of 0.01% and a taker fee of 0.06%. This fee structure is designed to promote higher liquidity through market-making.

MEXC also provides futures trading, yet the search results do not outline specifics regarding its fees and offerings in derivatives.

Phemex and MEXC extend their services beyond simple trading. They supply you with additional options such as:

- Staking: MEXC supports you in earning rewards through staking specific cryptocurrencies, although Phemex’s approach is not specified.

- Leveraged Tokens: You can access leveraged tokens on both platforms, offering more complex investment options with embedded leverage.

- NFT Marketplace: MEXC does not currently highlight an NFT marketplace offering, while Phemex’s stance on NFT trade is also unclear from the search results.

When choosing between Phemex and MEXC, your decision will ultimately depend on the services you prioritize.

For a wide array of cryptocurrencies, MEXC stands out, but if you’re looking for ian ntuitive user experience and competitive trading fees, Phemex may be your go-to exchange.

Consider how each platform aligns with your trading requirements and risk appetite.

Phemex vs MEXC: Contract Types

Phemex and MEXC offer various options to meet your trading preferences when examining contract types.

Phemex includes:

- Inverse Perpetual Contracts: You trade cryptocurrency pairs against another cryptocurrency, like Bitcoin (BTC) or Ethereum (ETH).

- Linear Perpetual Contracts: Here, you trade with contracts that use a stablecoin, typically USDT, as the quote currency.

- Options: Phemex allows you to trade options, which are financial derivatives, and speculate on the future price of an underlying asset.

On the other side, MEXC boasts:

- COIN-M Futures: Futures contracts are quoted in the actual cryptocurrency.

- USD-M Futures: Futures contracts are quoted in a fiat currency like the US dollar.

Both Phemex and MEXC provide inverse futures contracts, which allow you to hedge your positions and better manage risk in a volatile market. However, these contracts can be complex and carry a high level of risk, so they may not be suitable for all traders.

To provide clarity, here’s a comparative breakdown:

| Feature | Phemex | MEXC |

|---|---|---|

| Inverse Perpetual | Available | Available |

| Linear Perpetual | USDT as Quote | – |

| Options | Available | – |

| COIN-M Futures | – | Available |

| USD-M Futures | – | Available |

| Inverse Futures | Available | Available |

Understanding these contract types, benefits, and potential drawbacks is crucial for your trading strategy.

Remember, each type of contract can have different implications for your potential profit and loss and the risks involved.

Phemex vs MEXC: Leverage and Margin

When trading on Phemex or MEXC, you can leverage your positions. Leverage allows you to multiply your exposure to a market with a proportionately smaller amount of invested capital.

Phemex offers leverage up to 100x on certain products. This means that for every $1 you have, you can take a position worth up to $100.

However, with higher leverage comes increased risk, specifically the risk of rapid liquidation if the market moves against your position.

Phemex utilizes a margin system that specifies a Minimum Price Increment and includes a taker fee of 0.075%. The platform requires you to maintain a specific margin percentage to avoid liquidation.

MEXC, on the other hand, is known for offering a vast array of cryptocurrencies for trading and provides leveraged trading options.

While specifics on leverage caps can fluctuate, MEXC generally supports various leverage options. This extensive coverage allows you to select a leverage level suited to your risk tolerance and trading strategy.

Like Phemex, maintaining your margin above the maintenance level is crucial to prevent liquidation on MEXC, and fee structures are configured to be competitive.

- Phemex:

- Maximum Leverage: 100x

- Taker Fee: 0.075%

- Margin: Must maintain specified margin to prevent liquidation

- MEXC:

- Leverage: Offers a wide range of leverage options

- Fee Structure: Competitive fees

- Margin: Maintenance margin required

You must know the liquidation risks and funding rates associated with leveraged trading.

Both exchanges implement security measures to manage leverage risks, and you need to understand these mechanisms when trading on margin.

Use leverage with caution, as it can amplify both profits and losses.

Phemex vs MEXC: Liquidity and Volume

Liquidity is a crucial parameter when evaluating an exchange like Phemex or MEXC.

Higher liquidity indicates a more vibrant market, allowing instant and large-volume trades with minimal price slippage.

- Phemex: This derivatives platform is recognized for processing trades efficiently, with a daily trade volume exceeding $1.5 billion—this volume indicate market activity and liquidity. Besides, Phemex is ranked with an average liquidity score of 466 out of 1,000, reflecting its capability to handle spot trading orders effectively yet demonstrating room for improvement compared to top-ranking exchanges.

- MEXC: MEXC distinguishes itself with a comprehensive selection of more than 1,600 cryptocurrencies, fostering an environment that supports robust trading activity.MEXC is also proactive in adding new crypto tokens, attracting a variety of traders interested in lesser-known or novel assets, which in turn can influence the liquidity and volume of the exchange. It would be best if you examined the real-time liquidity scores and trading volumes, as these metrics are crucial for assessing market depth and the ability to execute orders at anticipated prices.

Slippage tends to be lower on an exchange with higher volumes and liquidity, improving your trading experience by providing better price certainty and quicker order fulfillment.

For current data and metrics, refer to monthly updated sources such as Cryptowisser or online exchange reviews.

Always ensure the information is up-to-date, considering the fast-paced nature of cryptocurrency exchanges, where rankings and metrics can change rapidly.

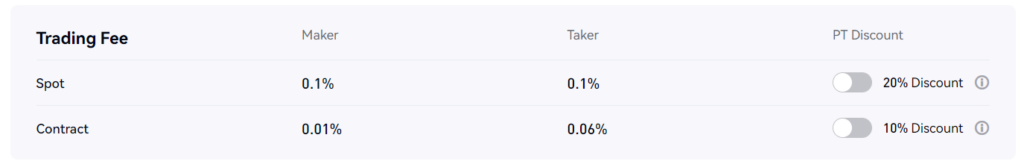

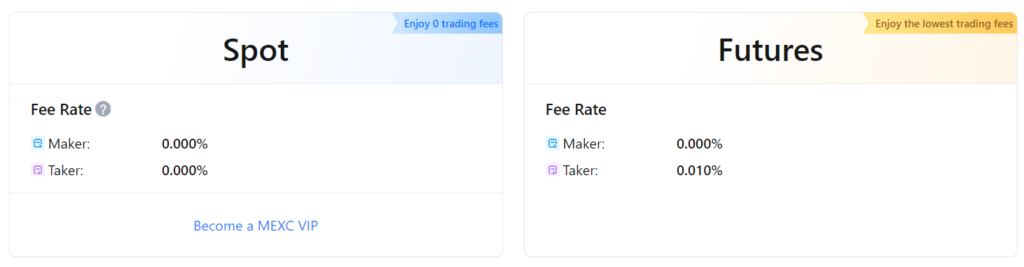

Phemex vs MEXC: Fees and Rewards

When trading on Phemex or MEXC, understanding the fee structure is crucial for your trading strategy.

Phemex operates with a competitive fee structure around maker and taker fees. As a maker providing liquidity, your costs are often lower than takers who remove liquidity from the market.

Phemex also extends zero-fee trading for premium members, which can significantly reduce your trade costs.

In contrast, MEXC’s fees follow the maker-taker model but are known for listing many cryptocurrencies. Depending on your trading volume, they might offer different fee schedules, notably decreasing fees for high-volume traders.

| Exchange | Maker Fees | Taker Fees | Premium/ VIP Benefits |

|---|---|---|---|

| Phemex | Competitive | Competitive | Zero-fee trading for premium members |

| MEXC | Tier-based | Tier-based | Lower fees for high-volume trades |

Rewards on both platforms can come in various forms, such as welcome bonuses, referral rewards, or reduced fees for specific actions.

Phemex often offers sign-up bonuses that may boost your initial trading balance.

MEXC, on its part, could provide rewards for participating in new token listings or staking opportunities.

When calculating trade fees, consider your role as a maker or taker, the asset you’re trading, and the applicable bonuses or rewards.

For instance, on Phemex, if you’re paying a 0.1% taker fee and trade $1,000 worth of Bitcoin, you will pay $1 in fees, excluding any applicable discounts or premium membership benefits.

On MEXC, your fees might decrease if your 30-day trading volume exceeds certain thresholds, potentially lowering the costs as your trading activity increases.

Always review the current fee schedules provided by each exchange, as they could be subject to change.

Phemex vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When you evaluate Phemex and MEXC, one of the direct comparisons lies in their fee structure. Understanding the nuances of trading and deposit and withdrawal fees could substantially affect your trading costs.

Phemex applies a trading fee model comprising maker and taker fees. As a maker (providing liquidity), you might pay less than a taker (taking liquidity). Typically, Phemex’s maker/taker fees peak at 0.1%. It’s essential to monitor changes as Phemex updates fees every 8 hours.

MEXC does not adhere to a tiered fee system, offering a flat trading fee for spot transactions. Although this simplifies the cost structure, comparing if flat fees align with your trading volume and strategies is crucial.

Both platforms charge withdrawal fees, with Phemex currently capping the highest withdrawal fee at 0.1%.

| Fee Type | Phemex | MEXC |

|---|---|---|

| Maker Fee | Up to 0.1% | Flat fee (varies) |

| Taker Fee | Up to 0.1% | Flat fee (varies) |

| Withdrawal Fee | Max 0.1% (subject to change) | Depends on asset |

| Deposit Fee | Generally free | Generally free |

Your deposits on both platforms are usually free, which is a relief considering the overheads on other platforms. However, always check for updates, as changes could occur without notice.

Phemex vs MEXC: Deposits & Withdrawal Options

When considering using an exchange for cryptocurrency transactions, understanding the deposit and withdrawal options is crucial. Each exchange may offer different methods, currencies, and limits, influencing your decision based on convenience, speed, and cost.

Phemex accommodates your deposits by allowing you to use credit cards, making the process fast and straightforward. You can leverage trades up to 100 times your initial investment.

Withdrawal options are also designed for efficiency, but always check for any associated fees and processing times, which can vary.

MEXC, on the other hand, provides you with a broader range of deposit methods. You can:

- Buy crypto using a debit/credit card.

- Make deposits through third-party payment providers such as Banxa, Mercuryo, Moonpay, or Simplex.

- Deposit or withdraw via global bank transfers, including SEPA/FPS.

- Transfer crypto tokens from other wallets or exchanges.

Both platforms allow crypto token transfers from other wallets or exchanges, which can be a familiar routine if you manage cryptocurrencies using different services.

Remember to consider the supported currencies on both exchanges, as they can differ.

Also, it is essential to review the minimum and maximum amounts for both deposits and withdrawals, accommodating your financial needs.

Processing time can impact how quickly you start trading or take out your funds.

Phemex vs MEXC: KYC Requirements & KYC Limits

When considering Phemex and MEXC, your experience on each exchange will depend heavily on their established Know Your Customer (KYC) protocols.

Phemex mandates KYC verification for all users looking to utilize their platform fully. You can access increased withdrawal limits once you provide the necessary identification, including a passport or ID card. The specific documents may vary depending on your location.

Should you choose not to verify your identity, be aware that your actions may be limited on the exchange.

MEXC operates with a tiered KYC system. Completing KYC is compulsory for depositing, withdrawing, and trading. Unverified users are restricted from accessing the exchange’s features.

As with Phemex, the documents required for verification with MEXC could differ by region.

| Feature | Phemex | MEXC |

|---|---|---|

| KYC Requirement | Mandatory for full access | Required for any activity |

| Verification Level | Identity documents | Multiple KYC levels |

| Deposit Limits | N/A without KYC | N/A without KYC |

| Withdrawal Limits | Enhanced with KYC completion | Enhanced through KYC tiers |

| Identity Documents | Passport, valid ID card | Varies by KYC level and region |

KYC affects your privacy by requiring you to share personal information with the exchange. However, it fosters security by ensuring all traders on the platform are authenticated, potentially reducing fraud and other financial crimes.

Your accessibility to the platforms’ features—trading, withdrawals, or deposits—will be directly tied to your KYC status.

Keep in mind that these procedures are set to protect both the user and the exchange from illicit activities.

Phemex vs MEXC: Order Types

When trading on Phemex or MEXC, you have multiple order types to strategize effectively.

Each order type is designed to give you more control over your trades, whether to capitalize on market movements or protect yourself from volatility.

Understanding these order types is essential for managing risk and executing trades according to your strategy.

Phemex offers a variety of order options:

- Market orders allow you to buy or sell immediately at the current market price.

- Limit Orders: Set the specific price you want to buy or sell.

- Stop Orders (Stop-Loss/Take-Profit): Trigger a buy or sell when the price reaches a certain level.

- Conditional Orders: Executed only when certain conditions are met.

- Post-Only Orders: Ensure the order is added to the order book and not matched with a pre-existing order, often used by market makers.

- Reduce-Only Orders: Ensures that a position is reduced but not increased.

MEXC provides similar order types along with some additional ones:

- Market Orders: For immediate execution at the available market price.

- Limit Orders: To set a predetermined price for execution.

- Stop Orders: Act as stop-loss or take-profit orders depending on your needs.

- Trigger Orders: A specialized type of stop order triggered under specific conditions.

- Trailing Stop Orders: Automatically adjust the stop price at a fixed distance from the market price.

- Post-Only Orders: This guarantees the trader pays the maker fee and avoids the taker fee.

You’ll find that both exchanges offer mechanisms to enhance trading precision and risk management. Your choice in using these orders will reflect your trading style, discipline, and risk tolerance.

Phemex vs MEXC: Security and Reliability

When selecting a cryptocurrency exchange, your security and reliability concerns are paramount. Phemex and MEXC understand this and have implemented robust measures to protect your funds and data.

Phemex prides itself on its security protocols, including two-factor authentication (2FA), which adds an extra layer of security to your account.

Their platform has not reported any major security breaches, a testament to their system’s integrity. For additional peace of mind, Phemex has a dedicated section for proof of reserve, ensuring transparency regarding the funds held on the platform.

MEXC also takes your security seriously, offering two-factor authentication to safeguard your login process. The exchange regularly updates its security measures to stay ahead of potential threats.

| Feature | Phemex | MEXC |

|---|---|---|

| Two-Factor Authentication | Yes | Yes |

| Proof of Reserve | Provided | N/A |

| Past Incidents | None reported | None reported |

Both exchanges comply with regulatory standards to ensure a secure trading environment. Your queries and issues are addressed by customer support teams, with Phemex offering support across various channels for convenience.

Although security incidents are notably absent in their histories, it’s crucial to remain vigilant and utilize all available security features to protect your account on both platforms.

Phemex v.s MEXC: User Experience.

When comparing the user experience between Phemex and MEXC, specific factors, such as the interface, trading tools, and customer support,t come into play.

Phemex prides itself on providing a streamlined interface that makes it simple for you to navigate the platform.

The charts are detailed and customizable, which is crucial for you as a trader seeking to analyze trends and execute trades.

Phemex’s robust trading tools offer various options to tailor your trading strategy.

The mobile app is designed for on-the-go trading, ensuring you don’t miss market opportunities.

Users have often noted Phemex’s responsive customer support, a significant aspect of the overall experience.

| Feature | Phemex | MEXC |

|---|---|---|

| Interface | Intuitive | User-friendly |

| Charts | Customizable | Advanced tools |

| Trading Tools | Extensive | Wide selection |

| Mobile App | Fast, reliable | Efficient, easy |

| Customer Support | Responsive | Helpful |

In contrast, MEXC also offers a user-friendly interface with sophisticated charting and analysis tools that cater to your need for advanced trading functionalities.

MEXC’s mobile app ensures that trading is efficient and accessible wherever you are.

The platform’s customer support is seen as reliable and helpful across various user reviews.

While both Phemex and MEXC are geared towards enhancing your trading experience, Phemex may have a slight edge in terms of the simplicity of its platform, appealing primarily to new traders.

On the other hand, MEXC’s offerings tend to attract you if you’re looking for a breadth of tools and a slightly more complex trading environment.

User scores and feedback generally highlight a positive experience on both platforms, with points going to Phemex for ease of use and to MEXC for its advanced features.

Phemex vs MEXC: Education and Community

When selecting a crypto trading platform, educational resources, and a supportive community can significantly impact your trading experience.

Both Phemex and MEXC offer various learning materials tailored to serve a diverse user base.

Phemex emphasizes education with a structured learning center that includes articles, trading guides, and tutorials.

The resources cater to various levels of traders. This allows you to grasp the basics of cryptocurrency trading or expand your knowledge with more advanced topics.

As for community support, Phemex maintains a robust presence across multiple social media platforms. They engage users with the latest crypto trends and build a cohesive ecosystem.

On the other hand, MEXC prides itself on having an extensive selection of cryptocurrencies. This is reflected in their educational content covering a wide range of digital assets. Their educational hub presents timely information that can aid you in making informed trading decisions.

Furthermore, MEXC’s multilingual support bridges language barriers, facilitating a global reach and a diverse community.

Both platforms also foster their communities through regular interaction on social platforms like Twitter and Telegram. This interaction provides valuable insight into user sentiment and platform updates, keeping you well-informed and connected.

| Phemex | MEXC |

|---|---|

| Learning Center with comprehensive trading resources | Educational content with a focus on numerous cryptocurrencies |

| Strong social media engagement | Support is available in multiple languages |

| Community-centric approach | Active community engagement on various social platforms |

Phemex vs MEXC: Regulation and Compliance

When assessing the regulation and compliance aspects of Phemex and MEXC, you’ll find that both platforms have implemented measures to align with the industry’s legal and ethical standards.

Phemex operates with a user-centric approach to regulation. They ensure compliance through Know Your Customer (KYC) verification procedures.

This effort demonstrates their commitment to adhere to anti-money laundering (AML) standards, although it has not explicitly targeted U.S. residents due to stringent regulations.

| Phemex | MEXC |

|---|---|

| KYC Compliance | KYC Compliance |

| AML Standards | AML Standards |

| No targeted service for U.S. residents | Restrictions for U.S. residents |

On the other hand, MEXC maintains a broader international user base. They also implemented regulatory practices to secure operational continuation.

Similar to Phemex, MEXC has integrated KYC verification for its users. This emphasizes their compliance with international AML directives.

It should be noted, however, that U.S. residents may encounter restrictions when attempting to access the full scope of MEXC services.

This is due to the comprehensive regulation by the Securities Exchange Commission (SEC) and other U.S. regulatory bodies.

Both platforms foster a neutral and secure trading environment.

Their compliance measures, while not often publicly detailed regarding certifications or licenses, are in place with standard financial service provider expectations.

While neither platform has disclosed that it is undergoing independent audits or holding formal certifications, its operational transparency has not yet drawn significant regulatory controversy.

It’s imperative to keep track of the ever-evolving landscape of regulatory requirements in the cryptocurrency exchange domain. Your trading activities depend on platforms continually adapting to new legal frameworks.

Conclusion

In comparing Phemex and MEXC, you’ll find distinct features that cater to various trader profiles.

MEXC boasts a broader selection of over 1,600 cryptocurrencies, favoring those who seek variety and early access to new tokens.

Meanwhile, Phemex appeals to users with zero transaction fees for premium members, emphasizing cost efficiency.

For Beginner Traders:

- MEXC offers multilingual support and a broad range of payment options, easing the learning curve.

- Phemex is known for its user-friendly design, which can be less daunting for new entrants.

For Experienced Traders:

- If your strategy involves an enormous scope of coins, including newer tokens, MEXC is your go-to.

- Do you prefer transaction cost-saving? Phemex’s premium membership could benefit your frequent trading activities.

Explore how Phemex and MEXC compare to their competitors:

- Phemex vs Kraken: Ultimate Trading Platform Comparison

- Phemex vs. BingX: Ultimate Trading Platform Comparison

- Phemex vs Binance: Ultimate Trading Platform Comparison

- MEXC vs Bybit: Ultimate Trading Platform Comparison

- MEXC vs BingX: Ultimate Trading Platform Comparison

- MEXC vs Kraken: Ultimate Trading Platform Comparison