Phemex and KuCoin are well-regarded cryptocurrency exchanges, each with unique offerings for traders. KuCoin is known for its extensive range of supported cryptocurrencies, user-friendly interface, and comprehensive trading options including spot, margin, and futures trading. Additionally, KuCoin provides various financial services such as staking, lending, and token launch platforms, appealing to a broad spectrum of traders.

Phemex, on the other hand, is recognized for its strong focus on derivatives trading, offering high leverage options and a professional-grade trading platform. It provides zero-fee spot trading for premium members and emphasizes speed, security, and a user-friendly experience.

| Feature | Phemex | KuCoin |

|---|---|---|

| Founded | 2019 | 2017 |

| Founder(s) | Jack Tao | Michael Gan and Eric Don |

| Trading Fees | Maker: -0.025% / Taker: 0.075% | Maker and Taker: 0.1% (can be lower with KCS use) |

| Supported Coins | Offers a selection of popular cryptocurrencies | Supports a wide range of cryptocurrencies |

| Leverage | Up to 100x for certain contracts | Up to 10x on certain pairs |

| Trading Volume | Lower compared to KuCoin | Higher compared to Phemex |

| Deposit Methods | Crypto deposits supports several fiat currencies | Free crypto deposits; a wider range of fiat options |

| Withdrawal Fees | Varies per cryptocurrency | Varies per cryptocurrency, generally low |

| Security Features | Cold wallet storage, 2FA | Industry security practices, 2FA |

| User Experience | User-friendly interface | Intuitive and feature-rich platform |

As you explore your options for cryptocurrency trading, you can use this table to compare the fundamental aspects of Phemex and KuCoin.

Each exchange has unique features and offerings that cater to different preferences in the trading community.

Phemex is known for its generous rebates to market makers, while KuCoin offers a low fee structure that can be reduced further using their native token.

Phemex Vs. Kucoin: Products And Services

When evaluating Phemex and KuCoin, it’s crucial to consider the range of products and services they offer.

Phemex is recognized for its futures and leverage trading, which includes a maker/taker fee structure, charging market takers 0.075% while offering rebates to market makers.

Products Unique to Phemex:

- Futures Trading: Attractive fee structure with rebates for market makers.

- Leverage Trading: Providing opportunities to trade with leverage.

In contrast, KuCoin boasts a more extensive selection of cryptocurrencies, with over 800 listed on its spot market and 250 on its futures market. Including unique altcoins not readily available on other platforms is KuCoin’s strength.

Products Unique to KuCoin:

- Extensive Spot Market: Access to a broader range of cryptocurrencies.

- Futures Market: A significant variety of futures contracts available.

- Staking: Options for earning rewards on your cryptocurrency holdings.

Both exchanges take security seriously. Phemex employs a hierarchical deterministic cold wallet system to protect user funds, while it is implied that KuCoin also implements robust security measures to ensure a safe trading environment.

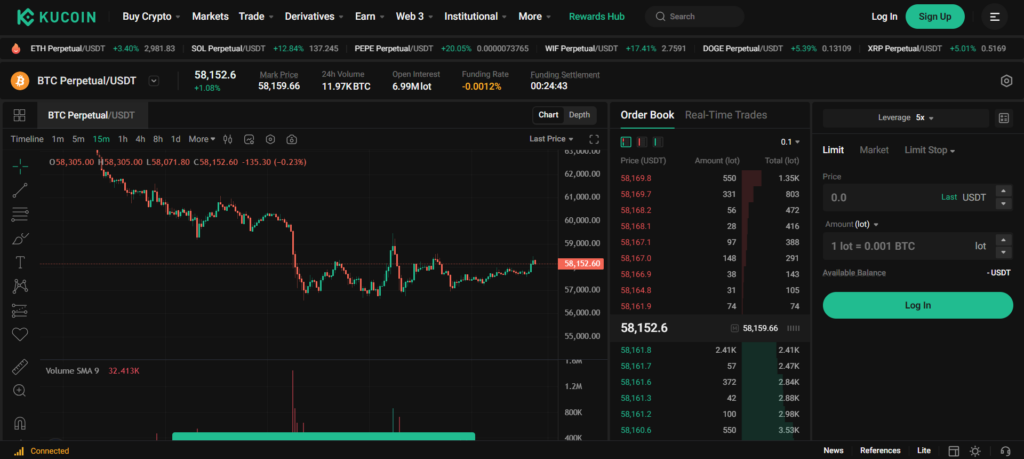

From a user experience standpoint, you’ll find that both platforms offer modern interfaces, though the ease of navigation may differ.

KuCoin has been hailed for its user-friendly approach, which is intuitive even for those new to cryptocurrency trading.

Consider your individual trading preferences when choosing between Phemex and KuCoin.

Whether it’s access to a wide range of cryptocurrencies or favorable trading fee structures, both exchanges serve different needs that may align with your trading strategy.

Phemex Vs. Kucoin: Contract Types

Phemex and KuCoin are prominent cryptocurrency exchanges that offer various contract types to cater to different trading preferences.

Phemex:

- Inverse Perpetual Contracts: You can trade contracts priced and settled in cryptocurrency, typically for Bitcoin. This lets you speculate on the price movements without owning the asset.

- Linear Perpetual Contracts: These contracts are quoted and settled in USDT, making them more accessible if you want to calculate your profits, losses, and margins directly in fiat equivalent.

- Inverse Futures Contracts: Futures worth considering if you aim for a fixed expiry contract priced in the native cryptocurrency.

KuCoin:

- COIN-M Futures: Here, you find futures contracts settled in the cryptocurrency. This type of contract is proper if you want to leverage your current cryptocurrency holdings without converting them to USDT or another base currency.

- USDⓈ-M Futures: Unlike COIN-M, these are settled in USDT and provide a straightforward way to participate in futures markets with a stablecoin anchor.

- Options: Useful if you’re looking to hedge other investments or speculate on prices with a different risk profile from futures. Options give you the right, but not the obligation, to buy or sell at a preset price.

Each contract type has its unique features and considerations.

Inverse contracts, whether perpetual or futures, involve directly handling cryptocurrencies, which can be preferred if you’re comfortable with the associated volatility.

Linear contracts, on the other hand, ease the process by tying directly to USDT. Options offered by KuCoin represent a separate class of derivatives with strategic potential for diverse trading methods.

When choosing between Phemex and KuCoin, consider your familiarity with the settlement currencies, trading strategy, and risk tolerance, as each contract type offers a different exposure to the volatile crypto market.

Phemex Vs. Kucoin: Supported Cryptocurrencies

When considering Phemex and KuCoin, you’ll notice both platforms cater to diversified portfolios of cryptocurrencies.

Phemex supports a more selective range yet includes most of the prominent names. In contrast, KuCoin stands out with its extensive list, offering you over 800 digital assets.

Phemex:

- Spot Trading: Focuses on significant cryptocurrencies.

- Futures and Leverage Trading: Includes popular trading pairs such as BTC/USD and ETH/USD, among others.

KuCoin:

- Spot Trading: Provides one of the most extensive selections, including numerous altcoins.

- Futures and Leverage Trading: Offers various futures trading options, often incorporating popular and niche cryptocurrency pairs.

Here’s a brief outline to help you compare:

| Feature | Phemex | KuCoin |

|---|---|---|

| Number of Spot Cryptocurrencies | Moderate | Over 800 |

| Futures Trading Pairs | Selective | Extensive |

You need to remember the array of cryptocurrencies when selecting an exchange for futures and leverage trading, as the choices may impact your trading strategy.

While KuCoin may provide a broader horizon for exploration, Phemex ensures that you have access to the most highly traded digital assets.

Phemex Vs. Kucoin: Leverage And Margin Trading

When considering leverage and margin trading on Phemex and KuCoin, it’s essential to understand the options available and how they can affect your trading strategy.

Phemex lets you engage in derivatives trading with up to 100x leverage, which means you can amplify your trading positions significantly.

However, with greater leverage comes the risk of quicker liquidation, so it’s crucial to manage your positions and margin carefully.

For spot trades, Phemex offers a margin of 3-10x. The exchange adopts a maker/taker fee structure, which affects your trading costs.

| Feature | Phemex | KuCoin |

|---|---|---|

| Maximum Leverage | 100x (derivatives) | 10x (isolated margin) |

| Spot Market Leverage | 3-10x | 5x (gross margin) |

| Maker/Taker Fees | Rebate of 0.025%/0.075% charge | Dynamic based on level |

In contrast, KuCoin offers a slightly more conservative leverage option for cross-margin trading, capped at 5x. The isolated margin on KuCoin can reach up to 10x.

The derivatives platform at KuCoin, KuCoin Futures, services a broad user base and provides additional contract varieties.

Like Phemex, higher leverage on KuCoin could lead to an increased liquidation risk if the market moves against your position.

Your choice between Phemex and KuCoin will depend on your approach to risk management, the levels of leverage you’re comfortable with, and the type of trades you wish to execute.

Always bear in mind that both leverage and margin trading comes with high risks and the potential for significant losses and gains.

Remember to factor in liquidation risks and funding rates when trading on margin, as these can impact your trades on both platforms.

Phemex Vs. Kucoin: Trading Volume

When assessing the trading volume of Phemex and KuCoin, you are examining a critical metric that influences trading efficiency, execution speed, and the potential for slippage on each platform.

KuCoin:

KuCoin boasts a considerable daily trading volume, with figures suggesting it exceeds $2.4 billion.

The high volume reflects the platform’s popularity and its capacity to Volumetate efficient trade execution, minimizing slippage—a critical aspectVolumeraders seeking to execute large orders.

| Metrics | KuCoin Data |

|---|---|

| Daily Volume | > $2.4 billion |

| User Base | Over 12 million |

| Cryptocurrencies | 800+ digital assets |

| Community | 20+ global communities |

Phemex:

In comparison, Phemex, though newer than KuCoin, is commended for its speed and has a substantial 30-day trading volume.

The exchange promotes zero-fee trading for premium members, which might attract traders and impact its volume. However, available data indicates that its trading volume is less than the volume of KuCoin.

| Metrics | Phemex Data |

|---|---|

| 30-Day Volume | Several billion Volumes |

| Trade Efficiency | High, due to platform speed |

| Volumeship | Offers zero fee for premium members |

The liquidity and voluVolumea rankings for each exchange are vital to you as they directly affect the immediacy of trade execution.

A higher trading volume, as obsVolumewith KuCoin, generally equates to greater liquidity, meaning your trades are likely to be executed swiftly and with less price variation.

Consequently, while KuCoin stands out in sheer volume, Phemex offers competitive features that may cater to specific tradinVolumeerences.

Phemex Vs Kucoin: Futures Trading Fees And Rewards

When you engage in futures trading on Phemex and KuCoin, understanding the fee structure and rewards is crucial for your cost management.

Phemex’s futures trading fees operate on a maker-taker model. As a market maker providing liquidity, you receive a rebate of 0.025%, effectively paying less than you would as a taker. Market takers, conversely, pay a fee of 0.075% for each transaction. There are no fees for overnight positions.

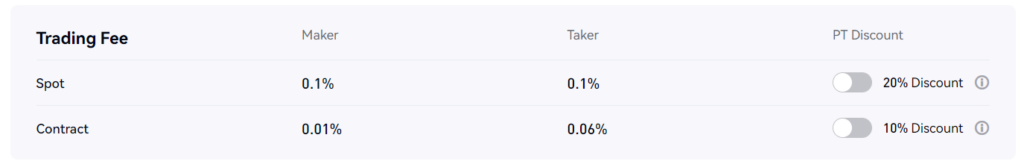

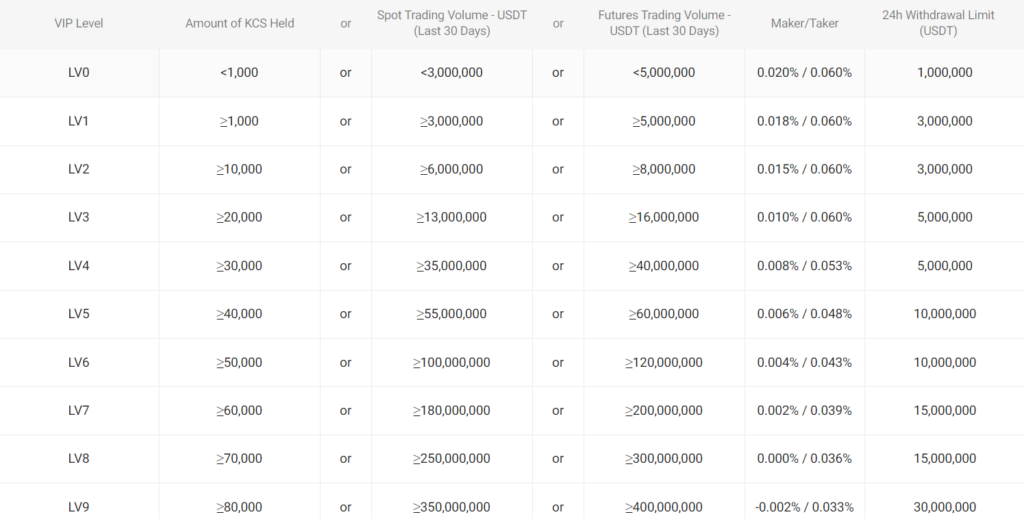

In contrast, KuCoin’s fee model for futures is also based on the maker-taker principle but may vary based on the user’s level within the KuCoin ecosystem.

Higher trading volume or holding the exchange’s native token might result in discounted fees.

- Example for Phemex: If you place a maker order for $10,000, your rebate would be $2.50.

- Example for KuCoin (assuming standard rate): A taker order for the same amount would cost you a fee of $7.50.

Fees for deposits and withdrawals are an additional consideration.

Generally, Phemex does not charge for deposits, but withdrawal fees are applicable and vary based on the cryptocurrency. Similarly, KuCoin may apply withdrawal fees and no charges for crypto deposits.

Both platforms incentivize trading through rewards such as bonuses or fee discounts for heavy-volume trading.

These can significantly impact your net profitability, especially when consistently trade large volumes or maintain positions over time.

| Platform | Maker Fee | Taker Fee | Deposit Fee | Withdrawal Fee |

|---|---|---|---|---|

| Phemex | -0.025% | 0.075% | $0 | Varies |

| KuCoin | Varies | Varies | $0 | Varies |

How these fees and rewards resonate with your trading strategies, and volume will influence your profitability when trading futures. Select the platform that aligns with your trading behavior to optimiVolumet efficiency.

Phemex Vs Kucoin: Deposits & Withdrawal Options

Specific options are available on each platform when you consider funding or taking out funds from your account on Phemex or KuCoin.

Phemex offers straightforward deposit methods. You can use your debit or credit cards from central banks for fiat deposits or transfer crypto assets directly from other wallets.

For withdrawals, Phemex supports only crypto assets and doesn’t allow fiat withdrawals.

- Deposit: Credit/Debit cards, Crypto transfer

- Withdrawal: Crypto assets only

| Method | Timeframe | Supported Currencies | Limits |

|---|---|---|---|

| Credit/Debit Card | Instant | Major Currencies | Varies |

| Crypto Transfer | Network-dependent | BTC, ETH, etc. | No max limit |

KuCoin, on the other hand, presents a broader range of withdrawal options, supporting over 400 coins and major networks.

With free crypto deposits, KuCoin ensures an easy process for transferring funds into your account. In comparison to Phemex, KuCoin accommodates a broader array of cryptocurrencies.

- Deposit: Free Crypto deposits

- Withdrawal: Over 400 coins, various networks

| Method | Timeframe | Supported Currencies | Limits |

|---|---|---|---|

| Crypto Deposit | Network-dependent | BTC, ETH, plus 400 more | No max limit |

| Crypto Withdrawal | Network-dependent | BTC, ETH, plus 400 more | Up to 2 BTC for standard users |

The differences in deposit and withdrawal methods can significantly affect the convenience, speed, and cost of managing your funds.

While Phemex is restrictive on withdrawals, KuCoin offers more versatility. The choice between the two may hinge on the type of currencies you deal with and whether you intend to withdraw in crypto or fiat.

Phemex Vs. Kucoin: Native Token Usage

Phemex and KuCoin have introduced native tokens, which play pivotal roles within their respective platforms.

As you navigate these exchanges, understanding the utility of these tokens is critical to optimizing your trading experience.

Phemex does not currently have a native token.

KuCoin, on the other hand, has the KuCoin Token (KCS). KCS holders benefit from various incentives on the KuCoin exchange.

Notably, by holding KCS, you can receive trading fee discounts. Additionally, KCS serves as a utility token within the KuCoin ecosystem, allowing you to participate in token sales and earn rewards, among other benefits.

Holding a certain amount of KCS is required to leverage the fee discounts, which can effectively lower your transaction costs on the platform.

| KuCoin | Usage |

|---|---|

| KCS | Enables fee discounts, access to token sales, and rewards. |

Understanding and utilizing these native tokens can significantly enhance your trading strategy and provide additional advantages on the respective platforms.

Phemex Vs Kucoin: KYC Requirements & Withdrawal Limits

Phemex and KuCoin have distinctive KYC (Know Your Customer) protocols, affecting your experience based on preference for privacy or higher transaction limits.

Phemex:

-

No KYC Required for Basic Trading:

- Trade anonymously with email registration.

- Daily withdrawal limit of 2 BTC for non-KYC users.

-

KYC Requirements:

- Optional KYC for increased limits.

- Provide identification documents to lift the daily withdrawal restriction.

KuCoin:

-

KYC Levels:

- Level 1 (Unverified):

- Daily withdrawal limit of $499.

- Access to essential trading services.

- Level 2 (Verified):

- Daily withdrawal limit increases to $1,999.

- Submit a government-issued ID and a facial verification.

- Level 3 (Advanced Verified):

- Highest limit of $999,999 daily.

- Additional documents and information may be required.

- Level 1 (Unverified):

-

Documents & Verification:

- For higher limits, provide personal information and official identification and go through verification procedures.

- Verification enhances account security and access to advanced features.

KYC requirements impact your privacy on both exchanges; you trade anonymously on Phemex with primary email verification but adhere to KYC for higher limits—a similar pattern is observed in KuCoin with its tiered approach.

Your ability to deposit, withdraw, and trade on these platforms hinges on the level of personal information you’re willing to disclose. Choose based on your preference for privacy or transactional freedom.

Phemex Vs. Kucoin: User Experience

When choosing between Phemex and KuCoin, it’s crucial to prioritize your ease of use and what you value in a trading platform.

The design, speed, and overall functionality contribute significantly to the user experience on both desktop and mobile applications.

Starting with Phemex, you’ll notice a user-friendly interface prides itself on smooth performance.

The platform’s clean and intuitive design is optimal if you’re starting crypto trading.

On mobile, the Phemex app continues to provide a simplified experience consistent with the usability of the web version.

- Desktop Interface: Streamlined navigation and organized tools for easy access.

- Mobile App: Consistency in design with the web, offering a seamless transition.

KuCoin, on the other hand, provides a comprehensive experience with a broader range of altcoins.

While the interface may appear slightly more complex due to the extensive features, it remains accessible, catering to both new and experienced traders.

KuCoin’s app mirrors the web platform’s capabilities, ensuring you can trade efficiently on the go.

- Desktop Interface: Extensive tools with a focus on feature-rich trading.

- Mobile App: Robust functionality that supports a complete trading experience.

Speed and Performance:

- Phemex: Known for rapid transaction execution and updates.

- KuCoin: Handles many operations effectively, though you may encounter busier periods.

In comparing both, consider how often you’ll trade on mobile versus desktop and the complexity of your trading strategy.

While Phemex might cater to swift and straightforward trading, KuCoin can offer a more varied and in-depth approach.

Phemex Vs. Kucoin: Order Types

Phemex and KuCoin are both cutting-edge platforms, providing a suite of order types that cater to various trading strategies and risk management needs.

Here’s a breakdown of the standard order types you’ll find on both exchanges:

Market Orders: A market order is your go-to type if you’re looking to buy or sell assets immediately at the current market price. It’s simple and ensures immediate execution, but remember that slippage may occur during periods of high volatility.

Limit Orders: Want more control over the price you pay or receive? Set a limit order. You specify the price you’re willing to buy or sell, giving you precision, but there’s no guarantee the order will be filled if the market doesn’t reach your set price.

Stop Orders: Your strategy to limit losses involves a stop order, which activates a sell or buy order when the asset hits a price you’ve determined, functioning as a risk management tool.

Conditional Orders: Both platforms also offer conditional orders, allowing you to set specific conditions that, once met, trigger an order. These are sophisticated tools for when your trading requires more finesse.

Phemex goes a step further with additional order types like:

- Post-Only Orders: Ensure your order is added to the order book and not matched with a pre-existing order, guaranteeing a maker rebate.

- Reduce-Only Orders: Prevents increasing your position size by ensuring that an order will only reduce a position, not create a new one.

While KuCoin doesn’t specifically list ‘post-only’ or ‘reduce-only’ labels, their advanced set of order types effectively covers these strategies through a combination of limit orders and conditionals.

Both exchanges update their trading tools regularly, so you’ll always have access to comprehensive and sophisticated order types to execute your trading strategies and manage your risks effectively.

Phemex vs KuCoin: Security Measures & Reliability

When evaluating the security measures of Phemex and KuCoin, it’s essential to consider how each platform works to protect your funds and personal information.

Phemex emphasizes the safety of your assets by employing a hierarchical deterministic cold wallet system. This method involves storing most funds in a multi-signature cold wallet, which requires offline signatures to access, greatly enhancing your security against potential online threats.

KuCoin similarly prioritizes the security of your trading experience. Details from available sources suggest that both KuCoin and Phemex have taken significant steps to prevent unauthorized access and potential breaches.

Historical Incidents:

- Phemex: Reports indicate an absence of significant security breaches, which points to a robust security protocol.

- KuCoin: In contrast, KuCoin has experienced security incidents in the past. However, the exchange responded promptly to resolve the situation and has since taken measures to fortify its security infrastructure.

Features at a Glance:

| Feature | Phemex | KuCoin |

|---|---|---|

| Cold Wallet System | Hierarchical Deterministic | Advanced Security |

| User Authentication | Multi-Factor | Multi-Factor |

| Past Incidents | No major breaches were reported | Previous incidents resolved |

Your confidence in an exchange not only comes from its security technology but also from their track record.

Both Phemex and KuCoin show a solid commitment to security; despite KuCoin’s past challenges, the exchange’s efforts to enhance safety should not be overlooked.

Phemex vs KuCoin: Insurance Fund

When you trade on cryptocurrency exchanges like Phemex and KuCoin, understanding how your funds are protected is crucial. Both platforms have mechanisms to safeguard your assets, specifically through an insurance fund.

Phemex:

Phemex does not have a public insurance fund. However, they maintain a rigorous security protocol for asset protection. They prioritize safeguarding your assets, but the specific details on an insurance fund aren’t as transparent as some other exchanges.

- Security measures include cold wallet storage.

- Provides safety against unforeseen losses during trading.

KuCoin:

KuCoin experienced a security incident in the past, but they’ve significantly boosted their defenses since then.

- Insurance Fund: This fund protects users against potential losses due to system risks.

- Cold Storage: Over 90% of assets are held in cold storage to minimize risks.

- Recovery: Most stolen funds were previously recovered thanks to insurance and rapid response.

It’s worth noting that an insurance fund can provide peace of mind but also underscores the importance of an exchange’s overall security infrastructure.

Comparison Table:

| Feature | Phemex | KuCoin |

|---|---|---|

| Public Insurance Fund | Not transparently disclosed | Yes |

| Cold Storage | Yes | Yes (>90% of funds) |

| Past Incident Recovery | Not specified | Recovered majority of stolen funds |

When choosing between Phemex and KuCoin, consider how they handle the safety of your digital assets regarding insurance funds and overall security measures.

Phemex vs KuCoin: Customer Support

When choosing a cryptocurrency exchange, customer support is crucial for your peace of mind and swift problem resolution. Both Phemex and KuCoin provide significant customer support services.

Phemex offers:

- 24/7 Direct-line Customer Support: You have constant access to assistance.

- Ticket System: If you encounter issues, you can raise a ticket.

- Social Media Presence: Reach out via Twitter, Facebook, Telegram, or Reddit for support.

KuCoin also provides customer support, but the specific details about their services are not covered as extensively in the search results. However, KuCoin generally:

- Support Channels: Has a reputation for a range of support options.

- Social Media: Is reachable for support on various social media platforms.

| Feature | Phemex | KuCoin |

|---|---|---|

| Availability | 24/7 | 24/7 |

| Support Line | Yes, direct line | Information not specified |

| Raise a Ticket | Yes | Likely available |

| Social Media | Twitter, Facebook, Telegram, Reddit | Presumably similar platforms |

It’s essential to verify the current state of customer support for both exchanges as services may evolve. When you need help, reliable and responsive customer support from your exchange can significantly impact your trading experience. Ensure you consider support options alongside other critical factors when deciding between Phemex and KuCoin.

Phemex vs KuCoin: Regulatory Compliance

When choosing a cryptocurrency exchange, it’s crucial to consider its regulatory compliance.

Phemex and KuCoin operate under respective legal frameworks that impact how they conduct business and manage your assets. Here’s how they align with regulatory standards:

Phemex:

- Jurisdiction: Incorporated in Singapore, known for its clear regulatory stance on crypto operations.

- Compliance: Adheres to the requirements of the Monetary Authority of Singapore.

- Security Measures: Employs a combination of technical strategies to ensure alignment with regulatory mandates.

- Audits: External audits are regularly conducted to verify compliance and security protocols.

KuCoin:

- Jurisdiction: Established in Seychelles, where the regulatory environment for cryptocurrencies has traditionally been more flexible.

- Compliance: Follows the regulations set by the nation of incorporation and engages with various market regulators globally.

- Security Enhancements: Addresses regulatory requirements through secure fund storage methods and robust authentication processes.

- Controversies: Has faced challenges such as reported security incidents, which have led to increased scrutiny and a tightening of their compliance measures.

Your choice should be informed by their compliance track record, the jurisdictions they operate within, and how seriously they take their regulatory responsibilities.

Both Phemex and KuCoin demonstrate an ongoing commitment to meet legal and ethical standards, although they operate under different national regulations and face distinct challenges in their compliance journeys.

Keep in mind the importance of these elements when making your decision to choose a crypto exchange platform.

Conclusion

When selecting between Phemex and KuCoin, your decision should align with your trading needs and expertise.

Phemex is suitable if you’re stepping into the cryptocurrency market for the first time. Its user-friendly interface stands out, simplifying your venture into trading.

The platform offers 24×7 customer support and low fees, which is advantageous when you seek quick assistance and cost-effective trading.

- For Beginners: Phemex’s simplicity is your starting point.

- Key Benefit: Round-the-clock support eases your learning curve.

On the other hand, KuCoin, established in 2017, is a haven for trading many altcoins.

Its 800+ digital assets and innovative income options like staking and mining present a robust ecosystem for traders looking to expand their portfolios.

- For Experienced Traders: KuCoin’s extensive asset range and income options match your trading acumen.

- Income Avenues: Staking and mining provide passive earning opportunities.

In wrapping up, align your choice with your trading goals:

- Choose Phemex for a straightforward platform that supports your initial trading journey.

- Opt for KuCoin if you’re poised to diversify and leverage various assets and passive income features.

Your decision is pivotal in shaping your trading experience, so prioritize an exchange that resonates with your trading style and growth aspirations.

Explore how Phemex and KuCoin compare to their competitors:

- Phemex vs Binance: Exploring Two Leading Trading Platforms

- Phemex vs Bitget: Exploring Two Leading Trading Platforms

- Bybit vs Phemex: Exploring Two Leading Trading Platforms

- KuCoin vs Binance: Exploring Two Leading Trading Platforms

- KuCoin vs Bybit: Exploring Two Leading Trading Platforms

- KuCoin vs BingX: Exploring Two Leading Trading Platforms