KuCoin and Deribit are leading cryptocurrency exchanges, each catering to different aspects of the trading spectrum. KuCoin, known for its extensive range of cryptocurrencies and user-friendly interface, appeals to both novice and experienced traders. It offers spot, margin, and futures trading, along with various financial services like staking and lending.

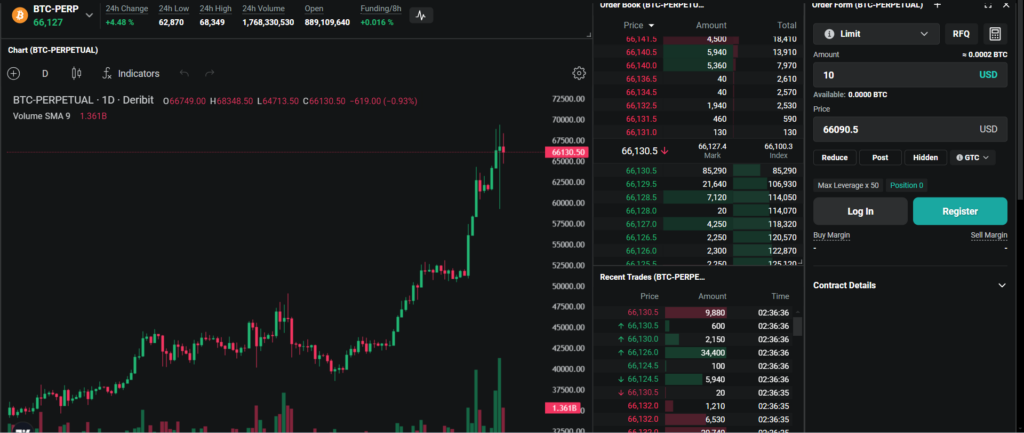

Deribit, on the other hand, specializes in derivatives trading, focusing primarily on Bitcoin and Ethereum futures and options. Renowned for its advanced trading tools and deep liquidity, Deribit attracts professional traders and institutions.

Comparing KuCoin and Deribit highlights their distinct strengths and helps traders choose the platform that aligns with their trading needs and expertise.

| Feature | KuCoin | Deribit |

|---|---|---|

| Founded | 2017 | 2016 |

| Founder(s) | Michael Gan and others | John Jansen and others |

| Supported Coins | Offers a wide selection of cryptocurrencies | Focuses mainly on Bitcoin and Ethereum derivatives |

| Leverage | Up to 10x for Spot Margin, 100x for Futures | Up to 100x for Futures |

| Deposit Methods | Multiple, including credit/debit card, crypto | Mainly crypto |

| Withdrawal Methods | Various, including crypto and bank transfer | Primarily crypto |

| Trading Volume | High | Comparatively lower as specialized in options and futures |

| Spot Trading Fees | 0.1% | It is not applicable as Deribit specializes in derivatives |

| Futures Fees | Maker: 0.02%, Taker: 0.06% | Maker: 0.0% to 0.03%, Taker: 0.03% to 0.05% |

| User Experience | User-friendly interface, suitable for various types of traders | Professional interface aimed at experienced traders |

Remember that your decision on which platform to use should be based on your specific trading needs and preferences.

Both KuCoin and Deribit provide different services that cater to various traders.

Consider the type of trading you will do, your experience level, and the features that are most important to you.

Kucoin Vs Deribit: Products And Services

When discussing products and services, KuCoin and Deribit offer different experiences. Your choice between the two may depend on the crypto services you seek.

KuCoin offers:

- Spot Trading: Buy and sell a wide array of cryptocurrencies.

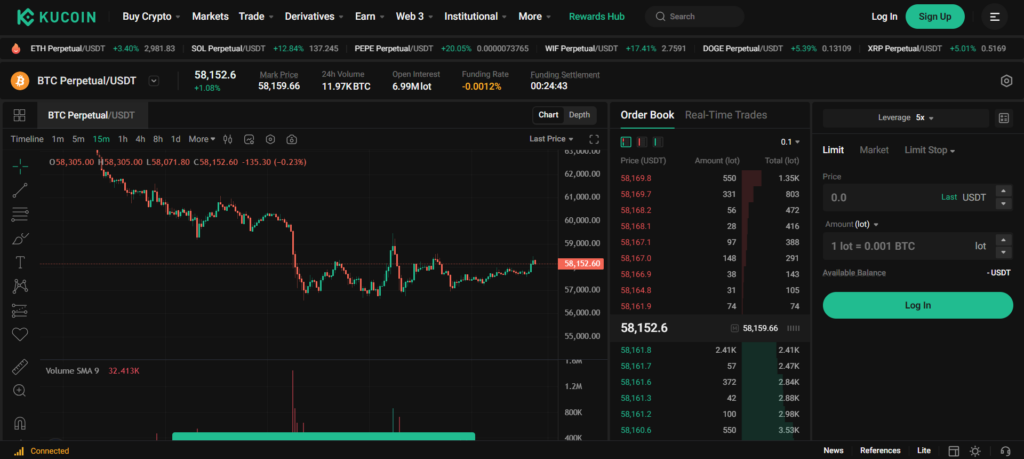

- Futures Trading: Engage with advanced market types, including perpetual futures.

- Staking: Earn rewards by staking various cryptocurrencies.

- NFT Marketplace: Explore the emerging world of non-fungible tokens.

- Leveraged Tokens: Trade with leverage without the need to manage margin manually.

On the other hand, Deribit specializes mainly in:

- Futures and Options Contracts: A focus on Bitcoin and Ethereum derivatives.

- Perpetual Futures: Trade perpetual contracts for BTC and ETH.

KuCoin, with its broader range of offerings, caters to various tastes and needs in the cryptocurrency space, emphasizing versatility. It allows you to engage in multiple types of crypto activities on a single platform.

Deribit, while more narrow in focus, offers a specialized experience for traders interested in futures and options. This could mean a more tailored user experience if your interest lies specifically within these areas.

With these contrasts in mind, assess what services align most with your interests and where you might find the most significant value.

Whether you lean towards greater diversity in trading options with KuCoin or specialize in Deribit‘s derivatives, focus, your choice should be informed by the unique products and services each platform excels in.

Kucoin Vs. Deribit: Contract Types

Understanding the types of contracts each exchange offers can significantly impact your strategies when trading cryptocurrencies. KuCoin and Deribit cater to various preferences with their contract selections, each with distinct features.

KuCoin’s Contract Types:

- Inverse Perpetual Contracts: Inverse contracts on KuCoin allow trading with the underlying cryptocurrency as collateral, which means you trade contracts using crypto instead of fiat currency.

- Linear Perpetual Contracts: These are quoted and settled in cryptocurrency, akin to buying a “fixed” amount of the digital asset. It simplifies the process if you are more accustomed to direct cryptocurrency values.

- Futures Contracts (COIN-M and USD-M):

- COIN-M futures: Traded directly using the cryptocurrency in question.

- USD-M futures: Contracts are traded and settled in USDT, providing a stable valuation method related to USD.

Deribit’s Contract Types:

- Inverse Futures Contracts: With these contracts, your gains or losses are in the base cryptocurrency, aligning with inverse perpetual contracts but with an expiry date.

- Options: Deribit is mainly known for its options market, offering European-style options that can be exercised only at the expiration date of Bitcoin and Ethereum.

Both platforms provide leveraged products, exposing you to higher potential gains alongside amplified risks.

The advantages of KuCoin’s contract suite include versatile futures types for trader preference and more straightforward linear contracts for direct crypto exposure.

Deribit, conversely, has an edge with its mature options market, appealing to traders with specific hedging or speculative needs that futures alone may not satisfy.

The drawbacks typically come in the form of complexity for beginners and the inherent risks associated with leverage and margin trading.

Always ensure you understand each exchange’s risk management features before trading these products.

Kucoin Vs Deribit: Supported Cryptocurrencies

When comparing KuCoin and Deribit, understanding the range of cryptocurrencies each exchange supports is crucial for your trading needs.

KuCoin is renowned for its extensive range of supported cryptocurrencies. With over 700 cryptocurrencies listed for spot trading, you have the flexibility to engage in a vast market of digital assets.

Regarding futures and leverage trading, KuCoin offers a diverse selection, providing you with several options to expand your investment strategy.

Deribit, primarily focused on options and futures trading, has a more specialized list of supported cryptocurrencies. It mainly revolves around Bitcoin and Ethereum, the bedrock of its futures and options trading platforms.

To present you with a clearer picture, here are the most popular futures trading pairs on each platform:

-

KuCoin:

- BTC/USDT

- ETH/USDT

- LTC/USDT

-

Deribit:

- BTC/USD

- ETH/USD

KuCoin offers futures and leverage trading for a broader selection beyond Bitcoin and Ethereum, placing it ahead if variety is significant for your trading strategy.

However, if you’re concentrating on Bitcoin and Ethereum derivatives, Deribit’s focused offerings in these markets could serve your needs effectively.

Kucoin Vs Deribit: Leverage And Margin Trading

When you want to amplify your trading position, KuCoin and Deribit offer leverage and margin trading options that enhance your trading capacity.

Understanding the nuances of each exchange’s offerings is critical to leveraging your trades effectively.

KuCoin Margin Trading:

- Maximum Leverage: KuCoin allows up to 10x leverage on specific cryptocurrency pairs.

- Margin Requirements: You must deposit a minimum amount to qualify for borrowing, acting as collateral.

- Liquidation Risk: Higher leverage comes with increased risks. KuCoin implements margin calls to prevent your position from reaching liquidation.

- Funding Rates: The cost of holding margin positions may vary and affect your trading costs.

Deribit Margin Trading:

- Maximum Leverage: Deribit is known for its high leverage, offering up to 100x on future contracts.

- Margin Requirements: To maintain positions, your initial margin must meet the exchange’s standards.

- Liquidation Risk: Deribit operates an incremental liquidation system to reduce the risk and impact of significant liquidation events.

- Funding Rates: Deribit charges rates exchanged between buyers and sellers, which change based on market conditions.

By comparing these factors, you can better decide which platform suits your margin trading needs.

Remember that leverage can magnify gains and losses, and adequate risk management strategies should be in place to protect your investments.

Kucoin Vs. Deribit: Trading Volume

When you’re evaluating KuCoin and Deribit, consider their trading volumes as a significant factor that influences your trading experience.

Trading volume strongly indicates an exchange’s liquidity, which impacts your transaction’s efficiency and potential slippage.

KuCoin:

- 24-hour Trading Volume: In recent data, KuCoin’s volume was reported at approximately $856 million, demonstrating significant market activity on its platform.

- Liquidity: High volume translates to high liquidity, meaning you can execute large trades with minimal impact on the market price.

Deribit:

- 24-hour Trading Volume: Deribit’s trading volume stands around $1.52 billion, overshadowing KuCoin’s figures and indicating active market participation.

- Liquidity & Efficiency: With this volume, Deribit offers you efficient trade execution, which is crucial if you engage in derivatives and options contracts.

When deciding where to trade, consider that higher volume often equals lower slippage, leading to more predictable entry and exit prices during your transactions.

Deribit’s focus on derivatives for Bitcoin and Ethereum corresponds with their high volume, as these more significant trades can be facilitated smoothly.

On the other hand, while kucoin’s overall trading volume is lower, it still maintains sufficient liquidity, possibly offering a broader array of trading pairs.

Your trading strategy and choice of cryptos may guide your preference; for high-volume derivatives trading, especially in Bitcoin and Ethereum, Deribit shows an edge.

If a diverse selection of trading pairs interests you, KuCoin could be beneficial despite its relatively lower volume.

Kucoin Vs Deribit: Futures Trading Fees And Rewards

When choosing a cryptocurrency futures trading platform, you should carefully consider the fee structures and rewards systems, as these factors significantly influence your trading costs and potential incentives.

KuCoin and Deribit provide distinct offerings in these areas that could sway your decision based on your trading habits and volume.

Fee Structure And Rewards System

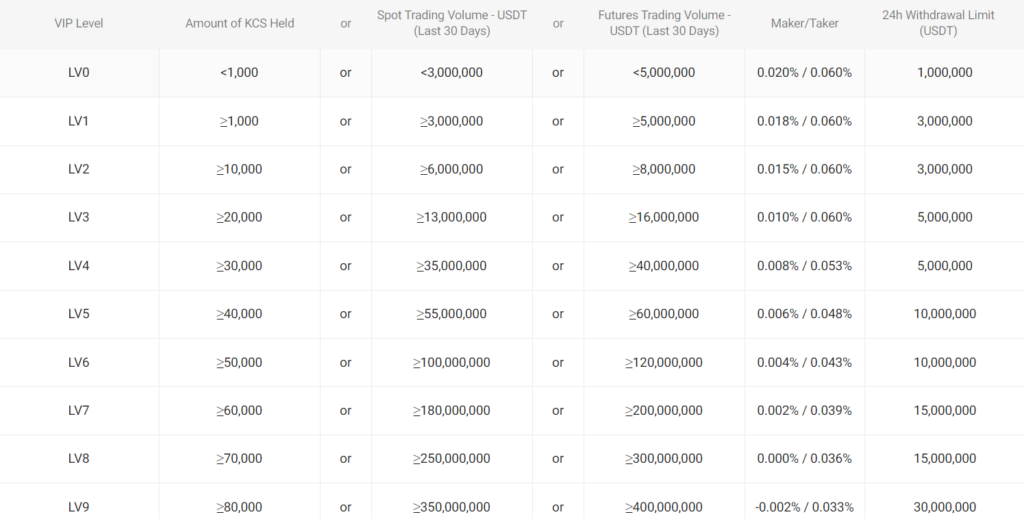

KuCoin operates with a tier-based fee structure where your fees are inversely proportional to your trading volume. For spot trading, market makers and takers start with a base fee of 0.1%.

In Futures trading, the fee varies and can be lower for higher-volume traders.

You can also receive trading fee discounts by holding KuCoin Shares (KCS), and the highest-level clients enjoy a negative maker fee, which means they receive a rebate when placing maker trades.

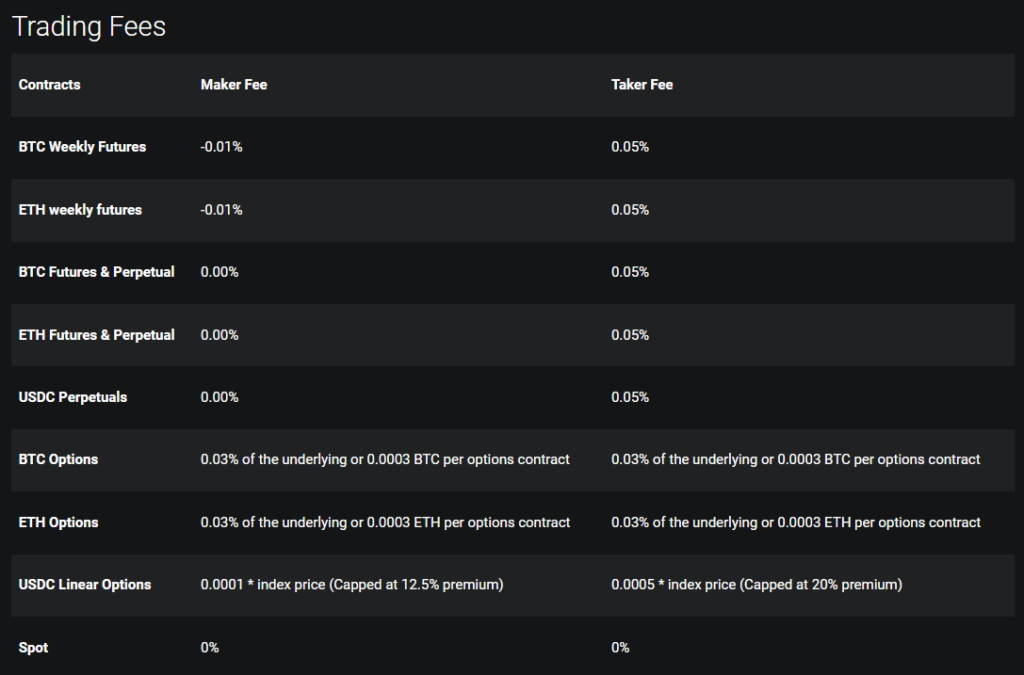

In contrast, Deribit’s fee schedule for futures is 0.05% for the maker and 0.075% for the taker.

Rewards come as potential fee reductions for high-volume traders but do not offer a negative maker fee structure akin to KuCoin’s.

Fee And Deposit/Withdrawal Fee Comparison

-

KuCoin:

- Maker Fee: Up to 0.1%, depending on trading volume

- Taker Fee: Up to 0.1%, depending on trading volume

- Withdrawal Fees: Based on the asset and network conditions

- Deposit Fees: Free for cryptocurrencies

-

Deribit:

- Maker Fee for Futures: 0.05%

- Taker Fee for Futures: 0.075%

- Withdrawal Fees: Variable based on the asset and network load

- Deposit Fees: No charge for Bitcoin deposits

To calculate your fees on KuCoin, if you trade 1 BTC for $50,000 with a taker fee of 0.1%, you would pay $50 in fees.

If using KCS for a discount, the fee could be reduced. On Deribit, for the same trade as a taker, the cost would be $37.50.

As your trading volume increases on either platform, these fees can decrease, affecting your profitability.

With Kucoin’s higher negative maker fee, you could earn a rebate, improving profitability for high-frequency, high-volume traders.

Kucoin Vs Deribit: Deposits & Withdrawal Options

When you’re looking to transfer funds, both KuCoin and Deribit provide various options, but they cater to different preferences regarding speed, convenience, and costs.

KuCoin:

- Currencies Supported: A wide range of cryptocurrencies, alongside fiat currencies.

- Deposit Methods: You can access credit/debit cards and bank transfers for fiat deposits.

- Withdrawal Methods: Includes bank transfers and cryptocurrencies.

- Processing Times: Processing times can vary, with crypto transactions often quicker.

- Limits: There is a focus on KYC verification. Once completed, your deposit and withdrawal limits are increased.

Deribit:

- Currencies Supported: Primarily focuses on Bitcoin, Ethereum, and USDC.

- Deposit Methods: Accepts deposits in Bitcoin (BTC), Ethereum (ETH), and USDC via their native blockchains.

- Withdrawal Options: Withdrawals are allowed in the same cryptocurrencies with varying withdrawal fees based on asset and market conditions.

- Processing Times: Typically swift for the supported cryptocurrencies.

- Limits: KYC verification may be required to generate a deposit address and allow withdrawal processing.

A notable difference lies in the supported currencies—KuCoin offers a range of cryptocurrencies and fiat, while Deribit is more crypto-focused, particularly with Bitcoin and Ethereum.

Due to the nature of crypto transactions, you’ll find swift processing times; however, fiat transactions can take longer on KuCoin due to banking procedures.

Remember, fees on both platforms can vary, with Deribit charging for fiat deposits via third-party services and withdrawal fees fluctuating with market conditions.

Kucoin Vs Deribit: Native Token Usage

KuCoin and Deribit are two recognized entities in cryptocurrency exchanges, each offering unique advantages through their native tokens. Here’s how you can utilize them:

KuCoin:

Your interaction with KuCoin’s native token, KCS (KuCoin Token), extends beyond basic trading. As an ERC-20 token, it operates on the Ethereum network and is supported by many Ethereum wallets.

By holding KCS, you can gain reduced trading fees, which encourages trading activity and holding of the token.

Additionally, KCS allows you to partake in the growth of the exchange as KuCoin continues to develop its infrastructure, including its decentralized trading solutions.

KCS Benefits:

- Reduced trading fees

- Participation in exchange growth

- Supported by most Ethereum wallets

Deribit:

In the case of Deribit, although it doesn’t have a native token utilized for fee discounts or exchange participation, it specializes in Bitcoin and Ethereum derivatives and options contracts.

Deribit’s focus remains distinct from KuCoin’s varied service offerings and does not integrate a utility token for its platform.

Deribit Features:

- Specialization in derivatives and options

- Bitcoin and Ethereum trading pairs

As a trader, consider not only the utility of native tokens but also the specific use cases and discounts they offer.

The strategic use of these tokens can significantly impact your trading experience and offer tangible benefits within the respective ecosystems of KuCoin and Deribit.

Kucoin Vs Deribit: KYC Requirements & KYC Limits

KuCoin and Deribit have distinct approaches to KYC (Know Your Customer) and the limits these procedures impose on your account.

KuCoin:

KYC Requirements:

- Verification Levels: KuCoin has introduced mandatory KYC verification for all users to align with global regulations.

- Documents: You must provide personal information, including government-issued identification.

- Procedure: The process is straightforward, requiring you to complete your identity verification on their platform.

KYC Limits:

- Withdrawal Limits: Upon completing KYC, KuCoin offers higher daily withdrawal limits.

- Without KYC: The exchange allows withdrawals but with a lower limit.

- With KYC: Enhanced daily withdrawal limit.

- Trading Limits: Full access to trading features might be restricted before KYC completion.

Deribit:

KYC Requirements:

- Verification Levels: Deribit also requires KYC for account functionality, though the specifics can vary.

- Documents: A valid ID and sometimes proof of residence are typically required.

- Procedure: You need to follow the instructions on the Deribit platform to verify your identity.

KYC Limits:

- Withdrawal Limits: Like KuCoin, Deribit enforces certain withdrawal limits based on your verification status.

- Without KYC, You will face limitations on the amount of funds you can withdraw.

- With KYC, The limits increase, allowing more flexibility in managing your assets.

- Trading Limits: Deribit may impose trading restrictions that can be lifted or altered after successful KYC verification.

Both exchanges implement these policies to safeguard against fraud and comply with regulations affecting your privacy and account usability.

The KYC process enhances both your security and the exchange’s integrity. Proper verification generally results in a smoother and more secure trading experience with enhanced limits on withdrawals and trading activities.

Kucoin Vs Deribit: User Experience

When comparing KuCoin and Deribit, your experience on each platform will differ notably due to their distinct offerings and interfaces.

Starting with KuCoin, you have a platform that’s feature-rich, accommodating over 700 cryptocurrencies. Its design is intuitive, making it suitable even if you are new to cryptocurrency trading.

On its web interface and mobile app, KuCoin provides advanced trading tools that remain accessible and relatively easy to navigate.

- Web Interface: Organized layout with clear navigation tabs.

- Mobile App: Robust app with nearly complete functionality of the web platform.

In contrast, Deribit is tailored more towards experienced traders, focusing primarily on Bitcoin and Ethereum derivatives.

Although it might not be as intuitive for newcomers, it offers a high-performance platform for dealing with complex products like futures and options.

- Web Interface: Professional, with tools and charts geared toward advanced users.

- Mobile App: Efficient, reflecting the platform’s specialization in derivatives.

Both KuCoin and Deribit are built to be fast and reliable.

KuCoin offers a more versatile experience with a broad asset selection and various trading types. In contrast, Deribit provides a specialized, institutional-grade trading environment with high liquidity for users keen on derivatives.

| Feature | KuCoin Experience | Deribit Experience |

|---|---|---|

| Interface | User-friendly | Professional |

| Speed | Fast | Fast |

| Trading Tools | Extensive | Specialized |

| Asset Variety | High | Limited |

Your choice between KuCoin and Deribit largely depends on your trading needs and your comfort with sophisticated trading options.

While KuCoin is accommodating for users of all levels, Deribit offers a platform where experienced traders can leverage advanced trading features and high liquidity in the derivatives market.

Kucoin Vs. Deribit: Order Types

When you trade on KuCoin, you have access to various order types that cater to your trading strategy and risk management needs.

One fundamental type is the market order, allowing you to buy or sell immediately at the best available price in the market.

Limit orders are your go-to if you prefer setting a specific price, as they execute only at your predetermined price or better.

For more advanced strategies, KuCoin supports stop orders, which trigger a market or limit order once the asset reaches a specific price, and conditional orders, executed only if particular conditions are met.

Additionally, to assist market makers in providing liquidity, post-only orders guarantee that your order is added to the order book and not matched with a pre-existing order, thus avoiding taker fees.

Deribit also offers an array of order types. Apart from market and limit orders, you can utilize stop orders for risk management.

Deribit’s API includes features like post-only and reduce-only orders for sophisticated traders These ensure that your position is either reduced, not increased or that it provides liquidity, helping optimize trading costs.

Here is a brief comparison:

| Order Type | KuCoin | Deribit |

|---|---|---|

| Market Order | ✓ | ✓ |

| Limit Order | ✓ | ✓ |

| Stop Order | ✓ | ✓ |

| Conditional Order | ✓ | None Specified |

| Post-Only Order | ✓ | ✓ |

| Reduce-Only Order | None Specified | ✓ |

KuCoin vs Deribit: Security Measures & Reliability

When considering KuCoin and Deribit, your security concerns are valid, given the nature of digital assets. KuCoin, established in 2017, has worked to build a robust security framework.

Your funds and data are guarded by multiple layers, including bank-level encryption and 2-factor authentication (2FA).

Should you choose KuCoin, it’s important to note that despite these precautions, they have experienced security challenges.

However, KuCoin has consistently worked on enhancing its defenses and maintaining transparency with users during recovery processes.

Deribit, primarily known as a platform for derivatives and futures trading, has its own security protocols.

One of their measures is the real-time auditing of their accounts, which helps to ensure that funds are available and protected.

Although incidents for Deribit have been less pronounced publicly, no exchange is immune to risks, and ongoing vigilance is critical.

As you compare both exchanges, remember that:

- KuCoin focuses on a multifaceted security approach that includes industry-standard practices and continuous improvement post-incidents.

- Deribit emphasizes preventive measures, particularly real-time monitoring, to safeguard your assets.

KuCoin vs Deribit: Insurance Fund

When trading on KuCoin or Deribit, a vital feature to understand is the insurance fund.

Both platforms employ this financial safeguard to protect traders in the event of sudden market movements that leave positions at the point of bankruptcy.

In the case of Deribit, they maintain an insurance fund to mitigate the risk of auto-deleveraging in leveraged trading.

Your position is more secure because, in volatile markets, the fund can compensate for losses that exceed traders’ account balances, thus reducing the likelihood of clawbacks from profitable traders.

KuCoin, on the other hand, utilizes the insurance fund to prevent auto deleverage when a trader’s position is liquidated at a price worse than the bankruptcy price.

This means that if the market does not have enough liquidity to fulfill all orders at the liquidation price, the insurance fund steps in to cover the losses.

This mechanism aids in maintaining market stability and protecting your funds during extreme market conditions.

Here’s a comparison of the insurance funds:

| Feature | KuCoin | Deribit |

|---|---|---|

| Purpose | To cover losses from liquidations that could not be executed favorably | To reduce the risk of clawbacks from profitable trades during liquidations |

| Benefit | Reduces chances of auto deleverage | Prevents clawbacks by covering excessive loss |

| Trading Type | Focus on a broader trading experience with various cryptocurrencies | Focused on leveraged trading with derivatives and options for Bitcoin and Ethereum |

Understanding the role and mechanics of the insurance fund on the platform you choose to trade is crucial for effective risk management.

Each fund has measures tailored to its trading environment to protect your interests in tumultuous markets.

KuCoin vs Deribit: Customer Support

When choosing a cryptocurrency exchange, customer support can be a crucial factor, especially if you’re relatively new to trading.

On one hand, you have KuCoin, which has become known for its customer service. KuCoin offers support via various channels, which means you can expect relatively quick and comprehensive assistance.

KuCoin Customer Support:

- Availability: Accessible through multiple channels

- User Interface: Caters to beginners and experts, although it can be less intuitive for new users

- Services: Offers advanced trading options

Conversely, Deribit focuses on experienced traders, offering high liquidity and trading primarily in Bitcoin and Ethereum derivatives.

The customer support is adequate, but there have been suggestions that it may need improvement.

Deribit Customer Support:

- Specialization: Tailored for experienced traders with a focus on derivatives

- Available Coins: Primarily Bitcoin and Ethereum

- Areas for Improvement: Some users have indicated that the customer service team could be more responsive.

When your trading involves more advanced and potentially riskier activities, such as derivatives and futures, having robust support you can rely on is paramount.

Therefore, you should weigh the responsiveness and quality of customer support heavily when deciding between KuCoin and Deribit.

Consider your trading style and need for support when making your choice.

KuCoin vs Deribit: Regulatory Compliance

Your choice between KuCoin and Deribit may be influenced by their adherence to regulatory standards.

KuCoin operates in over 200 countries and endorses global KYC (Know Your Customer) and AML (Anti-Money Laundering) standards.

Despite its wide operation range, KuCoin has faced regulatory challenges, such as not having licensure in the U.S., which imposes certain limitations on U.S. users’ access to its services.

Deribit, on the other hand, has a narrower focus, explicitly targeting the trading of Bitcoin and Ethereum derivatives.

It’s important to note that Deribit is not available to traders in the United States, and compliance with local regulations is a factor in this unavailability.

When considering regulatory compliance, look for:

- Licenses and Registrations: Review if the platforms have secured specific licenses in their jurisdictions.

- Operational Restrictions: Be aware of limitations due to the lack of local regulatory approval, especially concerning U.S.-based operations.

- Adherence to Standards: Evaluate how strictly the exchanges follow internationally recognized KYC and AML procedures.

It’s your responsibility to ensure that you are trading legally and that your funds are protected under the jurisdictions allowed by your chosen exchange.

Always review their current compliance status, as regulations can change.

Conclusion

When choosing between KuCoin and Deribit, your decision hinges on your trading preferences and needs.

KuCoin offers a wide range of cryptocurrencies and provides several services, including spot and derivatives trading.

It is versatile and caters to both novice and experienced traders.

If you are looking for a platform with various coins and tokens, KuCoin might be more suitable for your exploratory trading style.

On the other hand, Deribit specializes in futures and options trading, focusing primarily on Bitcoin and Ethereum.

It’s designed for traders interested in leveraging high-volume trades in these specific currencies, with leverage options up to 100x for BTC and 50x for ETH.

However, remember that increased leverage amplifies both potential gains and risks.

| Exchange | Best For |

|---|---|

| KuCoin | Diverse cryptocurrency options are user-friendly for various trader levels. |

| Deribit | Focused leverage trading in BTC and ETH for experienced traders. |

If you’re aware of trading costs, you’ll find KuCoin and Deribit have competitive fees, yet Deribit may offer more attractive terms for high-leverage positions.

No exchange is one-size-fits-all. Your specific trading strategy and risk tolerance will dictate the ideal exchange for you.

Adequate due diligence and an understanding of each platform’s offerings are vital. Whichever platform you choose, always trade responsibly.

Explore how KuCoin and Deribit compare to their competitors:

- KuCoin vs Bybit: A Detailed Comparison

- KuCoin vs Binance: A Detailed Comparison

- KuCoin vs OKX: A Detailed Comparison

- KuCoin vs BingX: A Detailed Comparison

- Bybit vs Deribit: A Detailed Comparison

- BitMEX vs Deribit: A Detailed Comparison