KuCoin and Kraken are prominent cryptocurrency exchanges, each offering unique features to cater to different types of traders. KuCoin is renowned for its extensive range of supported cryptocurrencies, user-friendly interface, and comprehensive trading options including spot, margin, and futures trading. It also provides financial services like staking, lending, and token launch platforms, making it suitable for a wide range of traders.

Kraken, on the other hand, is known for its robust security measures, regulatory compliance, and advanced trading tools. It offers a variety of trading options such as spot, futures, and margin trading, with a focus on providing a secure and reliable trading environment.

When choosing a cryptocurrency exchange, essential factors like fees, security, and available features dictate your experience.

Below, you’ll find a comparative table highlighting the critical aspects of KuCoin and Kraken to help guide your decision.

| Feature | KuCoin | Kraken |

|---|---|---|

| Founded | 2017 | 2011 |

| Founder(s) | Michael Gan | Jesse Powell |

| Supported Coins | Offers a wide range of cryptocurrencies | It also provides a broad selection of cryptocurrencies |

| Trading Volume | High, often ranked within the top 10 globally | High, especially noted for EUR markets |

| Trading Fees | 0.1% standard; can be reduced | Ranges from 0 to 0.26% depending on volume |

| Leverage | Offers leverage trading | It also provides leverage trading |

| Deposit Methods | Cryptocurrency, credit/debit card, bank transfers | Cryptocurrency, bank transfers |

| Security Measures | Cold storage, 2FA, encryption, audits, bug bounties | Cold storage, 2FA, encryption, audits, bug bounties |

| Fee Reductions | Possible with KCS coin usage | Discounts available for high-volume traders |

| Instant Buy Fees | Typically 3-5% | Usually around 1.5% |

| Withdrawal Fees | Depends on the crypto | It also varies by cryptocurrency |

Consider your trading style and needs when you compare these exchanges.

If low trading fees are a priority, your research might lean toward KuCoin.

Kraken’s structure may be more appealing if you’re focused on buying and holding crypto with less concern for trading fees.

Keep security measures, available cryptocurrencies, and your preferred deposit methods in mind.

KuCoin vs Kraken: Products and Services

KuCoin and Kraken offer a variety of products and services tailored for cryptocurrency traders and investors.

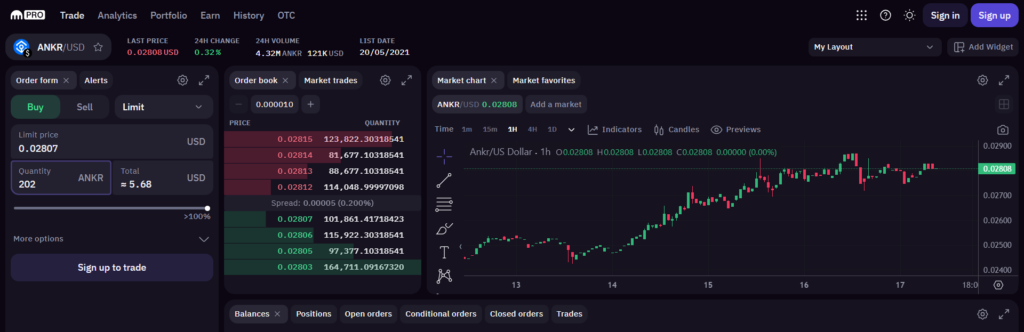

Spot Trading: You can participate in spot trading on both KuCoin and Kraken. KuCoin boasts a significant volume with a wide range of cryptocurrencies for trade.

While more minor in volume, Kraken is recognized for a smooth user experience.

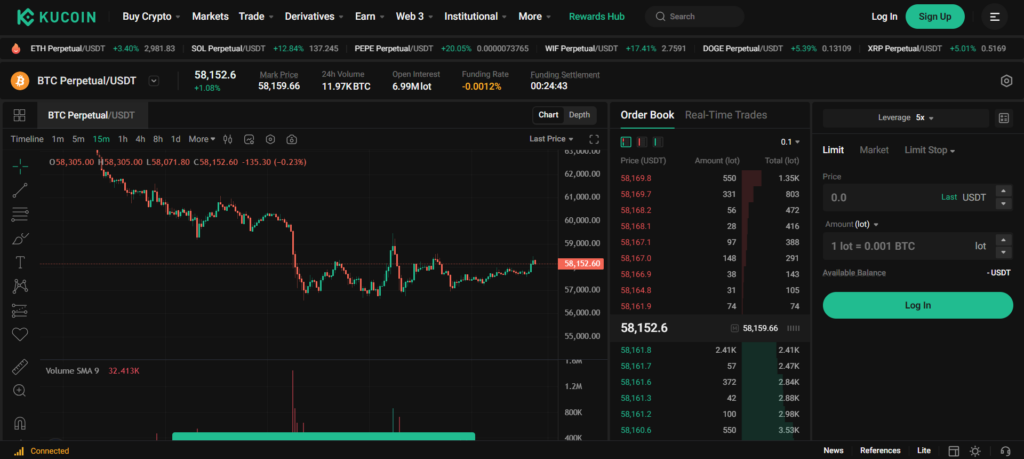

Futures & Options Trading: If you’re interested in futures trading, Both platforms serve your needs, with Kraken offering a structured and established trading experience.

KuCoin, on the other hand, provides a range of futures markets.

Staking & Earn Products: Kraken facilitates staking with a solid feature. KuCoin further expands this service through a suite of crypto lending, interest-bearing products, and cloud mining.

Below is a tabulated overview:

| Feature | KuCoin | Kraken |

|---|---|---|

| Spot Trading | High volume, extensive crypto coin selection | Comparatively lower volume, user-friendly |

| Futures & Options | A broad range of markets | Established and structured experience |

| Staking & Earnings | Crypto lending, interest accounts, cloud mining | Straightforward staking feature |

KuCoin and Kraken are accessible globally, with KuCoin available in over 200 countries, highlighting its broad geographic reach.

Your choice between the two will hinge on your specific trading and investment needs, with KuCoin favoring those seeking diverse passive income opportunities and Kraken serving traders prioritizing a streamlined experience and structured products.

KuCoin vs Kraken: Contract Types

You’ll notice some distinct differences when exploring the contract options on KuCoin and Kraken. These platforms offer diverse contract types to cater to your trading preferences and risk tolerance.

KuCoin:

KuCoin primarily offers the following types of contracts:

- Inverse Perpetual Contracts (Coin-Margined): These allow you to hold positions with a cryptocurrency as collateral. The main benefit is that you can hedge existing spot positions without converting to a stablecoin or USD.

- Linear Perpetual Contracts (USDT-Margined): These contracts use USDT as collateral. It’s simpler for you as you can calculate your profits, losses, and margin requirements directly in USD value.

- Futures Contracts: These include inverse futures, which are settled in the underlying crypto, and USDT-margined futures, which are settled in USDT.

Kraken:

Kraken’s contract offerings include:

- Inverse Perpetual Contracts: Similar to KuCoin, these contracts are settled in the underlying cryptocurrency, such as Bitcoin, and offer a straightforward way to speculate on price movements.

- Options: If you’re looking for the ability to buy or sell an asset at a predetermined price within a set timeframe, options contracts are available on Kraken.

Both platforms support leveraged trading with these contracts, which increases both your potential profit and potential risk.

Your choice between KuCoin and Kraken might depend on your preferred contract type, desired collateral, or simply which platform’s user experience resonates with you.

Derivatives trading involves significant risk and is not suitable for all investors. Before engaging in futures, options, or any other type of contract trading, ensure you fully understand these risks and have adequate experience.

KuCoin vs Kraken: Supported Cryptocurrencies

When choosing between KuCoin and Kraken, you’ll find that both exchanges offer a diverse array of cryptocurrencies, catering to various trader preferences.

KuCoin boasts a vast selection of cryptocurrencies, supporting over 700 individual coins. This array of assets provides a broad spectrum of options to diversify your portfolio.

In terms of futures and leverage trading, KuCoin enables these investment strategies, further expanding your trading possibilities. Some of the most popular futures trading pairs on KuCoin include, but are not limited to:

- BTC/USDT

- ETH/USDT

- LTC/USDT

On the other hand, Kraken provides a more curated list supporting over 150 cryptocurrencies.

Despite offering fewer cryptocurrencies, Kraken is still recognized for its robust selection of popular and stable assets.

As for futures and leverage trading, Kraken also facilitates these types of trades. You can engage in futures trading with pairs such as:

- BTC/USD

- ETH/USD

- LTC/USD

Considering both platforms, you should weigh the importance of the number of cryptocurrencies available versus your individual trading needs.

Whether you’re looking for a wide variety or a highly selective pool of well-known cryptocurrencies, KuCoin and Kraken provide differing but compelling options for your crypto trading journey.

KuCoin vs Kraken: Leverage and Margin Trading

When you’re exploring the functionalities of KuCoin and Kraken, it becomes clear that both platforms offer potential mechanisms for traders to enhance their trading strategies through leverage and margin trading.

KuCoin:

- Maximum Leverage: Offers up to 100x on certain products.

- Margin Options: Provides isolated and cross-margin trading, which you can select based on risk assessment.

- Liquidation Risks: High leverage increases potential return but also amplifies liquidation risks.

- Funding Rates: Subject to change based on market conditions.

Kraken:

- Maximum Leverage: Extends margin trading with a maximum of 50x leverage on specific pairs.

- Margin Options: Majorly offers isolated margin trading.

- Liquidation Risks: Lower leverage means reduced risk compared to KuCoin, but being mindful of liquidation thresholds is critical.

- Funding Rates: The interest rate on margin loans commonly settles around 8% annually but varies with market dynamics.

Table Summary:

| Feature | KuCoin | Kraken |

|---|---|---|

| Max Leverage | Up to 100x | Up to 50x |

| Margin Types | Isolated & Cross | Isolated |

| Funding Rates | Market Dependent | ~8% per annum |

Margin trading allows you to open more prominent positions than your account balance by borrowing funds.

However, while increased leverage can amplify your potential gains, it raises the stakes if the market moves against you.

Each platform’s requirements, like initial margin and maintenance margin, dictate how much you can borrow and the threshold for potential liquidation. It is essential to understand these elements before engaging in such trading activities.

KuCoin vs Kraken: Trading Volume

When comparing KuCoin and Kraken trading volumes, you’ll find key differences that impact your trading experience.

Higher trading volumes typically indicate more liquidity, which can lead to more effortless execution of trades and minimal slippage.

Kraken:

- Daily spot trading volumes: Over $1 billion

- Daily derivatives trading volumes: Around $100 million

KuCoin:

- Comparable to Kraken in spot trading volume

- $800 million in 24-hour trading volume

The trading volume on Kraken positions it as a more established exchange with a more extensive user base, offering a solid choice for fiat-to-crypto transactions and for those looking to invest in cryptocurrency.

Its considerable volume across spot and derivatives markets underlines its presence among top exchanges based on liquidity.

KuCoin’s trading volume is slightly behind Kraken but remains competitive. Despite a smaller 24-hour trading volume, KuCoin still maintains nearly comparable liquidity, facilitating efficient trade execution for its users.

Sources:

- Kraken’s $1 billion-plus spot trading volumes and $100 million derivatives trading volumes are reported by platforms like Coingecko.

- KuCoin’s $800 million trade volume also comes from data aggregated by cryptocurrency analytics platforms.

Kraken leads in overall volume, which may benefit you if you seek a platform with high liquidity.

KuCoin is not far behind, indicating healthy activity, and also represents a viable option depending on your trading requirements.

KuCoin vs Kraken: Futures Trading Fees and Rewards

In the competitive landscape of cryptocurrency futures trading, both KuCoin and Kraken provide distinct fee structures and rewards that cater to various trader profiles.

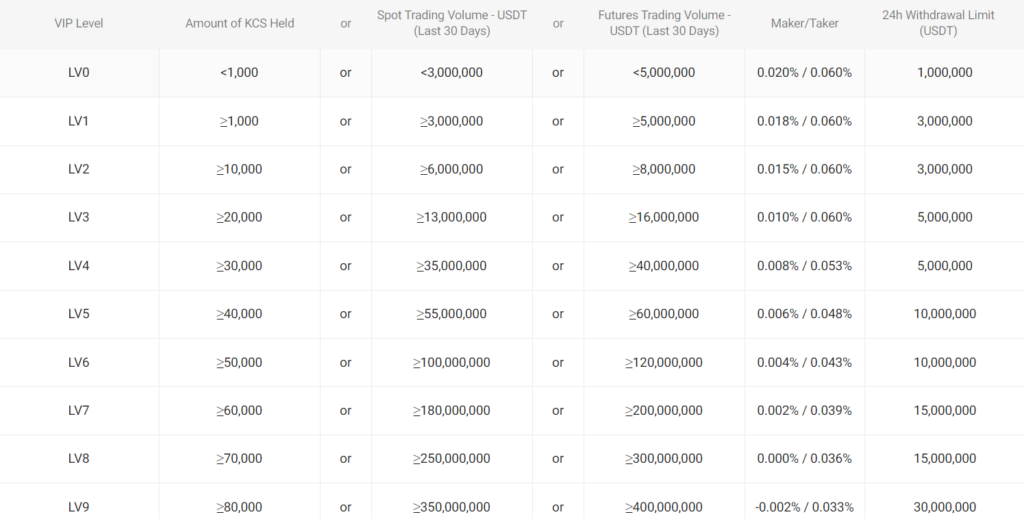

KuCoin operates with a standard futures trading fee. The maker fee starts at 0.02% and the taker fee at 0.06%. You can benefit from a lower fee if you trade in higher volumes or hold a certain amount of KuCoin Shares (KCS), which entitles you to a fee discount.

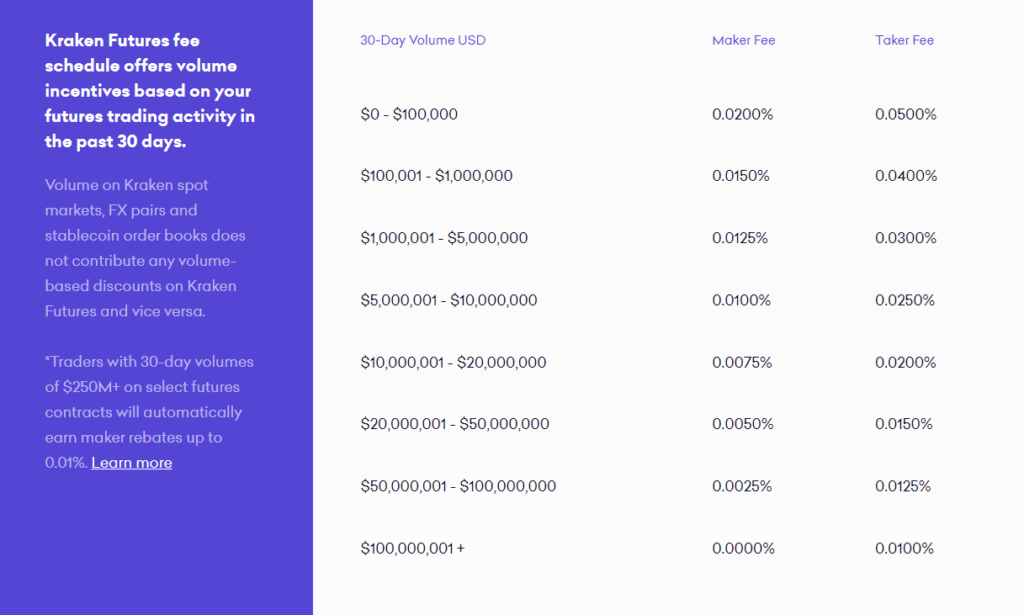

On the other hand, Kraken also offers a tier-based fee schedule for futures trading.

At Level 1, for a trading volume of up to $100,000, the maker fee is set at 0.02%, while the taker fee is 0.05%. Like KuCoin, the more you trade, the lower your costs.

Here’s a breakdown of the futures trading fees:

| Exchange | Maker Fee | Taker Fee | Volume Required |

|---|---|---|---|

| KuCoin | 0.02% | 0.06% | Standard |

| Kraken | 0.02% | 0.05% | Up to $100,000 |

Withdrawal Fees: It’s essential to remember that aside from trading fees, each exchange has different withdrawal fees, which vary based on the specific cryptocurrency you want to withdraw.

Rewards: Both KuCoin and Kraken offer rewards programs. KuCoin’s rewards include discounts for holding KCS, while Kraken provides lower fees for higher volume traders, which can be particularly rewarding for active traders looking to minimize costs.

When choosing an exchange for futures trading, it’s essential to consider your trading volume, potential fee discounts, and the rewards that align with your trading strategy.

These factors will significantly influence your trading costs and, consequently, your overall profitability. Explore each platform’s fee structure and reward system thoroughly before making your trading home.

KuCoin vs Kraken: Deposits & Withdrawal Options

When you’re choosing a cryptocurrency exchange, ease of moving your money is crucial.

Here’s a breakdown of the deposit and withdrawal options for KuCoin and Kraken and how they might impact your transactions.

KuCoin:

- Currencies Supported: Offers a wide range, including fiat and cryptocurrencies.

- Payment Methods:

- Fiat: SEPA, Skrill, PayPal, Apple Pay, Debit/Credit Card

- Crypto: Various cryptocurrencies supported

- Processing Times: Can vary; instantaneous for specific methods, while others may take a few business days.

- Limits: Relatively flexible, with different limits based on verification levels.

With KuCoin, your deposit options are diverse, allowing you to fund your account from different sources. Crypto transactions are usually quick, but fiat options can take longer depending on your chosen method and location.

Kraken:

- Currencies Supported: A broad range, including significant fiat and cryptocurrencies.

- Payment Methods:

- Fiat: Bank Transfer (ACH, Fedwire, SWIFT, Wire Transfer), Apple Pay, Google Pay, SEPA, Debit/Credit Card (restrictions apply)

- Crypto: Supports numerous cryptocurrencies for deposit

- Processing Times: These usually range from instant to a few days for fiat, but crypto transactions are typically quicker.

- Limits: Varies by account tier, with more stringent verification offering higher limits.

Kraken facilitates many fiat options, especially those in USD, EUR, and CAD. You’ll find that funding your account through crypto is efficient, while some fiat channels may require more patience.

Both exchanges impose minimum and maximum amounts on transactions determined by various factors such as the chosen currency, payment method, and user verification level.

Fees are also necessary; they differ across platforms, and some methods may incur higher costs than others.

Always check their websites’ latest fee structure to ensure you get the best deal.

KuCoin vs Kraken: Native Token Usage

KuCoin and Kraken offer native tokens that provide various benefits within each platform. As a user of these exchanges, it’s essential to understand how these tokens can enhance your trading experience.

KuCoin: KCS Token

KuCoin utilizes KCS (KuCoin Shares) as its native token. Holding KCS entitles you to:

- Trading fee discounts: Paying with KCS grants you a 20% discount.

- Tiered fee structure: The more KCS you hold, the greater the discount on trading fees.

- Additional benefits: Beyond fee reductions, KCS holders may receive other rewards and incentives within the KuCoin ecosystem.

Kraken: No Native Token as of 2024

Kraken, on the other hand, does not have a native token. Instead, the platform focuses on offering:

- Low fees: Based on volume, Competitive trading fees range from 0% to 0.26%.

- Volume-based discounts: High-volume traders enjoy discounted fees without needing a native token.

Comparison Table

| Exchange | Native Token | Fee Discount with Token | Additional Token Benefits |

|---|---|---|---|

| KuCoin | KCS | Yes, up to 20% | Rewards, incentives |

| Kraken | None | N/A | Volume-based discounts |

Your choice between KuCoin and Kraken may include consideration of native tokens and associated benefits.

KCS holders on KuCoin enjoy discounted fees and potential rewards, while Kraken offers a more straightforward fee discount based on your trading volume.

KuCoin vs Kraken: KYC Requirements & KYC Limits

KuCoin and Kraken enforce Know Your Customer (KYC) regulations that require users to verify their identity. This measure is in place for security and to prevent illicit activities.

KuCoin allows you to start trading with primary account verification, which involves providing an email address and phone number.

However, to lift certain limitations, you must complete advanced KYC verification, which includes submitting identification documents such as a passport or driver’s license and a selfie for facial verification.

Kraken’s KYC procedures vary based on your location and account verification level.

Kraken requires your full name, date of birth, address, and phone number.

Additional documents like a government-issued ID and proof of residence through a utility bill or similar records are needed for higher verification tiers.

Verification Levels & Limits

-

KuCoin:

- Basic Verification:

- Daily Withdrawal Limit: 2 BTC

- Fiat transactions: Not allowed

- Advanced Verification:

- Increased withdrawal limits

- Access to fiat transactions

- Basic Verification:

-

Kraken:

- Starter Level:

- Daily Withdrawal Limit: Not available for fiat

- Fiat transactions: Not allowed

- Intermediate Level:

- Requires ID and proof of residence

- Daily Withdrawal Limit: Increased limits

- Access to fiat deposit and withdrawal methods

- Pro Level:

- Requires additional financial information

- Highest withdrawal limits

- Full access to all trading and OTC services

- Starter Level:

KYC limits influence your deposit, withdrawal, and trading capabilities. At early verification stages, KuCoin offers a higher crypto withdrawal limit than Kraken’s starter level.

For more significant limits and full access to services, both exchanges require you to complete more detailed verification processes.

KuCoin vs Kraken: User Experience

When you navigate the KuCoin and Kraken platforms, immediate differences in design and functionality are evident.

KuCoin’s interface is known for its modern design, providing a vibrant and intuitive experience.

Your journey through the platform is bolstered by comprehensive help resources ideal for beginners and seasoned traders.

On mobile, KuCoin’s app continues this trend, striving for a seamless trading process.

KuCoin:

- Web Interface: Streamlined and modern

- Mobile App: User-friendly with comprehensive support

- Functionality: Suits a range of users, from beginners to experts

In contrast, Kraken presents a more subdued but equally professional interface.

Kraken focuses on facilitating a smooth user experience with an interface that is easy to comprehend and navigate.

Whether you are on their regular or pro mobile app, you can expect excellent functionality, as the apps cater to both quick transactions and sophisticated trading strategies, respectively.

Kraken:

- Web Interface: Professional and straightforward

- Mobile App: Offers two versions – regular for simplicity, pro for advanced users

- Functionality: High usability for severe and casual traders

Both platforms are efficient regarding speed, ensuring performance issues do not hinder your trading.

The design across both platforms favors clarity, simplifying your decision-making process considerably.

Whether you trade on KuCoin or Kraken, you’ll find that each exchange has tailored its user experience to accommodate your needs in the cryptocurrency market, with their unique strengths becoming apparent as you engage more deeply with their respective services.

KuCoin vs Kraken: Order Types

When trading cryptocurrencies, you have a variety of order types at your disposal on both KuCoin and Kraken.

Understanding these order types is crucial as they enable you to effectively execute your strategies and manage risks.

- Market Orders: On both KuCoin and Kraken, market orders allow you to buy or sell immediately at the current market price. This is your go-to if you need to execute a trade quickly.

- Limit Orders: Both exchanges offer limit orders, which enable you to set a specific price at which you’re willing to buy or sell a cryptocurrency. Your order will only be executed if the market reaches your specified price.

- Stop Orders: These are essential for risk management. On both KuCoin and Kraken, a stop order becomes a market order once a set price level is reached. It’s a way to limit potential losses.

- Conditional Orders: KuCoin and Kraken facilitate conditional orders, executed only if certain conditions are met, offering you more control over your trade execution.

- Post-Only Orders: These are available on both platforms. Post-only orders ensure you pay the maker fee and not the taker fee. Your order won’t execute if it matches an order already in the book.

- Reduce-Only Orders: These orders are designed to reduce your position, not increase it. Both KuCoin and Kraken support reduce-only orders in their futures trading section.

Additional order types may include:

- Take Profit Orders

- Stop-Limit Orders

- Trailing Stop Orders

KuCoin and Kraken each provide various order types that support different trading strategies and risk management practices. Please familiarize yourself with each type so you can use them to your advantage.

KuCoin vs Kraken: Security Measures & Reliability

When evaluating the security measures of KuCoin and Kraken, it’s crucial to consider various factors that contribute to their reliability.

Both exchanges have implemented robust security protocols to safeguard your investments.

KuCoin:

- Cold Storage: A significant portion of digital assets are securely stored offline.

- Encryption: Industry-level multilayer encryption prevents unauthorized data access.

- Authentication: Dynamic multi-factor authentication adds an extra layer of security.

- Internal Controls: A dedicated risk control department monitors transactions daily.

Kraken:

- Cold Storage: Just like KuCoin, Kraken uses cold storage to keep assets secure.

- Encryption: Comprehensive encryption practices are in place to protect data.

- Authentication: Two-factor authentication (2FA) is a standard feature.

- Audits and Programs: Regular audits and bug bounty programs are conducted to strengthen security.

In terms of past incidents, both exchanges have faced challenges but have shown resilience in addressing them:

- KuCoin experienced a security breach in 2020, where they promptly took measures such as freezing all affected funds and collaborating with other exchanges to track stolen assets, ultimately leading to significant recovery of the funds.

- While not immune to attempts of breaches, Kraken has managed to keep a clean security record due to its rigorous security practices. It has continually improved its defense mechanisms over the years.

When you select an exchange, assessing security features like these assures that your funds and personal information are handled carefully.

KuCoin vs Kraken: Insurance Fund

When you’re trading cryptocurrencies, the security of your funds is paramount.

Understanding KuCoin and Kraken’s insurance funds provides insight into the level of risk management these platforms offer.

KuCoin:

KuCoin established a security incident response mechanism, which proved its efficiency when the platform was hacked.

They swiftly responded by recovering a substantial portion of the stolen funds, and their insurance covered the remaining unrecovered amount.

This incident demonstrates KuCoin’s commitment to safeguarding user assets and the effectiveness of its insurance fund in mitigating potential losses.

- Quick Response: Effective actions during security incidents

- Recoveries: Successfully retrieved majority of hacked funds

- Insurance Coverage: Remaining losses covered, securing user assets

Kraken:

Kraken is known for its robust security measures. Although there’s less public detailing of Kraken’s insurance policies, its reputation for safety and a sound security infrastructure offer reassurance for users regarding the protection of their assets.

- Security Infrastructure: Emphasis on robust safety measures

- Asset Protection: Cold storage for the majority of assets enhances security

As you engage in exchange activities on these platforms, it’s clear that both value user security and have implemented measures to manage and mitigate potential risks to your digital assets.

KuCoin vs Kraken: Customer Support

Customer support is a vital factor when choosing between KuCoin and Kraken.

KuCoin provides a range of customer support services, including 24/7 live chat, where you can quickly interact with real people to solve your issues.

Additionally, KuCoin offers assistance through crypto lending, margin trading, and futures, which may include relevant customer support services for these features.

On the other hand, Kraken also strongly emphasizes customer support by offering live chat around the clock.

Furthermore, Kraken has established a dedicated phone support line at 1-855-777-7603, operating from Monday to Friday between 6 a.m. to 6 p.m. EST.

Contacting via email ticket request is also provided for a more formal approach to support.

Support Features Comparison:

-

KuCoin:

- 24/7 Live chat

- Trading bots

- Crypto lending

- Margin trading

- Futures support

-

Kraken:

- 24/7 Live chat

- Phone Support: 1-855-777-7603 (Mon-Fri 6 a.m. to 6 p.m. EST)

- Email support

Your preference for one platform over the other may depend on whether you value the accessibility of phone support or the convenience of integrated support within trading features.

Consider how each exchange’s support offerings align with your trading needs and preferences.

KuCoin vs Kraken: Regulatory Compliance

As you explore the worlds of KuCoin and Kraken, you’ll find that both exchanges take regulatory compliance seriously.

They strive to align with the legal and regulatory frameworks of the regions in which they operate.

Kraken, for instance, is known for its adherence to regulatory standards in the United States and for securing state-by-state licenses for operation.

Kraken also obtained a Wyoming SPDI bank charter, affirming its compliance and financial security commitment.

- Licensed to operate across various US states

- Holds a Wyoming SPDI bank charter

- Ongoing compliance with US regulatory standards

KuCoin, on the other hand, serves a global audience and operates in many countries. Its approach to compliance is to adapt to the local regulations of over 200 countries and territories. KuCoin’s regulatory strategy is molded by the diverse jurisdictions it encompasses.

- Submits to regulatory standards of multiple nations

- Customizes compliance measures to align with local laws

Both exchanges have faced regulatory scrutiny, as the crypto market often treads new legal ground.

Kraken has had to navigate through settlement cases with the SEC, reinforcing its commitment to compliance.

Meanwhile, KuCoin’s international presence means it must deal with a patchwork of legal requirements that present challenges.

As you consider your options, regulatory compliance is not just about following laws. It’s about your security and the integrity of your transactions.

Kraken and KuCoin understand and reflect this in their efforts to remain within their legal frameworks.

Conclusion

When choosing between KuCoin and Kraken, your decision should align with your trading preferences and priorities.

- For Lower Fees: If minimizing fees is your top priority, KuCoin might be more attractive with its standard fee of 0.1%.

- Volume Traders: If you’re trading in higher volumes, Kraken could benefit from its volume-based fee discounts.

- Security-Conscious Users: Both platforms implement robust security measures, including cold storage, two-factor authentication (2FA), and encryption. Frequent audits and bug bounty programs are part of their commitment to security.

- User Experience: Kraken is noted for its smooth user interface, which could be particularly appealing if you value ease of use.

- Asset Variety: KuCoin supports many cryptocurrencies and could be your go-to exchange for many cryptocurrencies.

- New Traders: If you are new to cryptocurrency trading, you may appreciate the straightforward user experience offered by Kraken.

Consider platform stability, customer support, and available services beyond basic trading.

You must select an exchange that isn’t just favorable regarding fees or security and aligns well with your overall trading and investment strategies.

Explore how KuCoin and Kraken compare to their competitors:

- KuCoin vs Bybit: Analyzing Two Popular Trading Platforms

- KuCoin vs BingX: Analyzing Two Popular Trading Platforms

- KuCoin vs Phemex: Analyzing Two Popular Trading Platforms

- Kraken vs Bybit: Analyzing Two Popular Trading Platforms

- Kraken vs Binance: Analyzing Two Popular Trading Platforms

- Kraken vs MEXC: Analyzing Two Popular Trading Platforms